- Summary:

- WTI crude oil prices retreated slightly as US President Donald Trump promises to bridge the supply gap caused by the Saudi production cut.

WTI crude oil retreated slightly after US President Donald Trump pledged to bridge the supply shortfalls that resulted from the weekend attack on Saudi Aramco’s oilfields that halved Saudi production. WTI had spiked nearly 12% in Monday trading to $63.75 per barrel, but retreated to $58.77 slightly after President Trump’s pledge.

However, latest reports monitored from Bloomberg, which have quoted an insider close to the situation have stated that officials of Saudi Aramco are pessimistic about an early recovery of the crude oil output following the drone attack. As of writing, WTI crude oil has started to pull up again and is now trading at $60.1 per barrel.

Technical Play for the Day

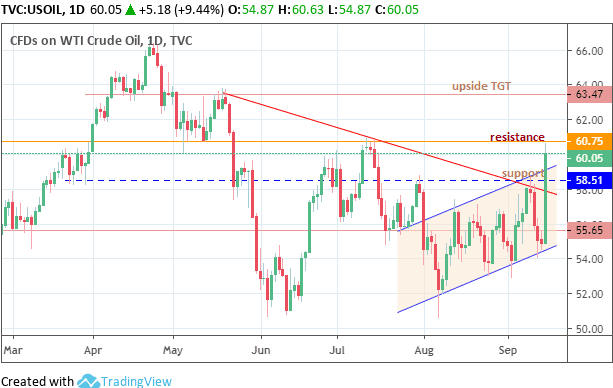

A look at the daily chart of crude oil shows that today’s spike has pushed WTI crude out of the up channel and the upper trendline that stretched from the May 2019 highs to the high of September 10.

Below the current price, the intersection of the down trendline, the channel’s return line and the horizontal price level that corresponds to the previous low of March 22 is expected to form support. A breach below the support level could open the door for a test of the $55.65 price level (July 2019 low).

To the upside, resistance is seen at the intraday high of $63.75 (May 20 high). If price is able to violate this level to the upside, this will bring $66.50 (April 23 high) into focus.

Current bias for WTI crude is bullish, so it is possible we could see dip buys moving for the next day or two. The situation is still fluid so traders must watch the news for further developments in price action.