- Summary:

- Brent Crude oil prices maintained a 9.5% price gap from Friday’s closing price of $60.12 per barrel as geopolitical tentions pick up.

As Monday’s trading session was getting underway, Brent Crude oil prices maintained a 9.5% price gap from Friday’s closing price of $60.12 per barrel. The motivation for the rise in price was attacks on Saudi Arabia crude oil production facilities that have left about 5% of world production offline. It is not clear when production will be able to resume.

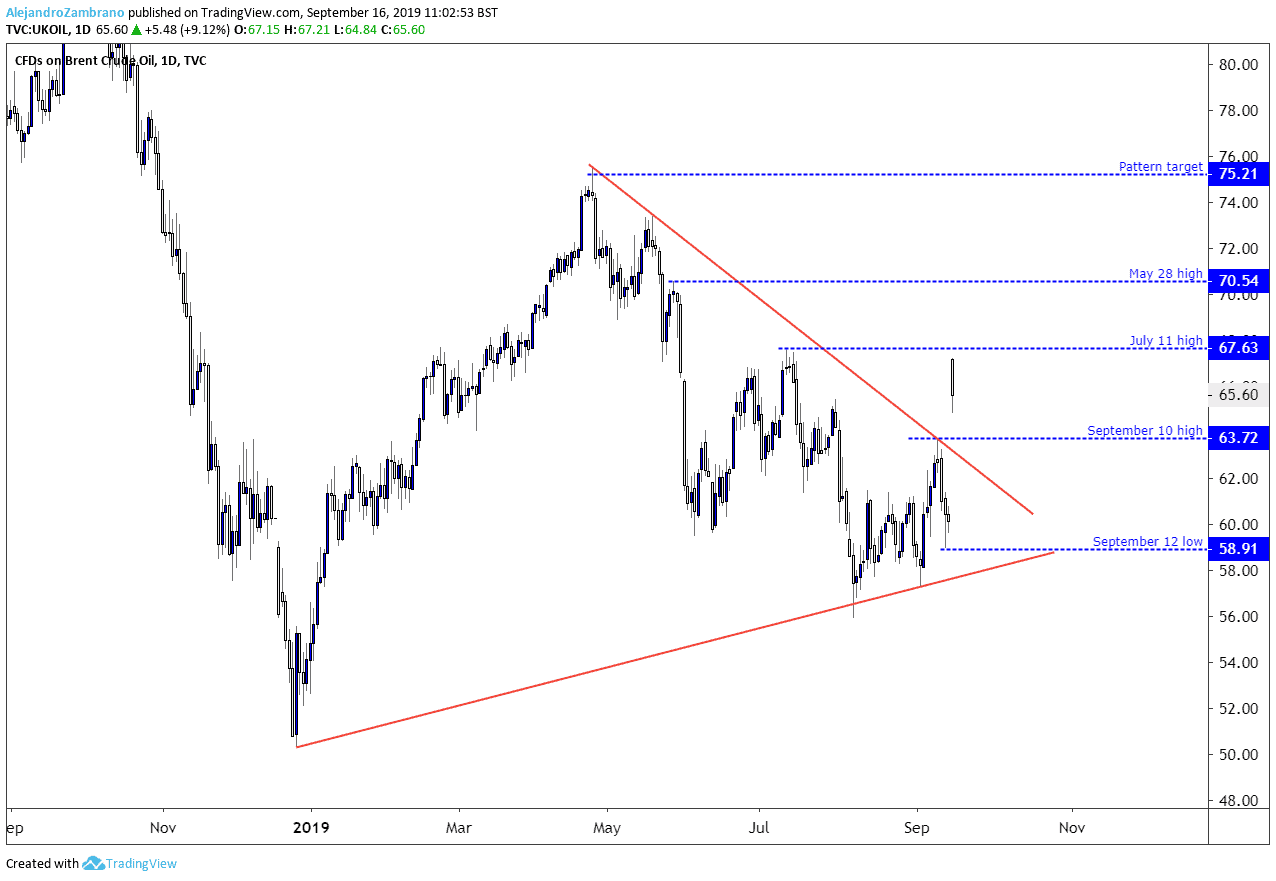

The strong move from Friday’s close triggered a triangle pattern that we first reported on Saturday. The triangle pattern is a technical analysis structure, and it is now hinting that crude oil prices could trade as high as $75.21 which also happens to be the 2019-high. The pattern will remain valid as long as crude oil prices trade above the September 12 low of $58.91.

In the short-term, it looks like crude oil prices will try to test the validity of the breakout and it would not be surprising if the price tests the September 10 high of $63.72. Between the September 10 high and Friday’s close price, I think the price might turn higher again, and target Sunday’s high.

The upward trend in crude oil prices will now depend on how quickly Saudi crude oil production will resume. Something that is said to take weeks and not days. Another, likely driver of price is the probability of a war with Iran. Over the weekend, the US Secretary of State blamed Iran on the attacks without providing any proof. However, unnamed US official has talked with Reuters, New York Times, and ABC, and suggested that the lunch site for the attack was in the northern Gulf, Iran, or Iraq. Iran has denied the claims that it was them attacking the facilities.

This morning, U.S. energy secretary, Rick Perry, said in a speech “Despite Iran’s malign efforts, we are very confident that the market is resilient and will respond positivity. Tensions and speculations will be driving prices going forward, and crude oil price volatility will remain high.

Hopes have been that the rest of OPEC members will supply more crude oil to alleviate the situation, however, that has so far not progressed well, and the UAE said that “it is still early for an emergency OPEC meeting”, as they need to assess the impact on oil markets. The UAE energy minister also said the country was able to boost output if needed, and if Saudi Arabia called for an OPEC emergency meeting they would deal with it.

For our view on WTI crude oil prices see: Crude Oil Prices Trade Sideways, Watch These Levels