- Summary:

- USDJPY continues higher for seventh consecutive trading session as the rebound which started in August 26th from 104.44 lows stalled today at 108.17 the yen

USDJPY trades 0.18% higher at 107.99 after disappointing macro figures; Japan Producer Price Index (month over month) came in at -0.3% below expectations of -0.2% in August; Actual Japan Producer Price Index (year over year) came in at -0.9%, below expectations of -0.8% in August. On the other hand the Japan Machinery Orders (year over year) came in at 0.3% topping forecasts of -4.5% in July.

The pair hit the daily low at 107.77 and the daily high at 108.16. The central bank of China set the Yuan rate (USDCNY) at 7.0846 versus yesterday fix at 7.0843.

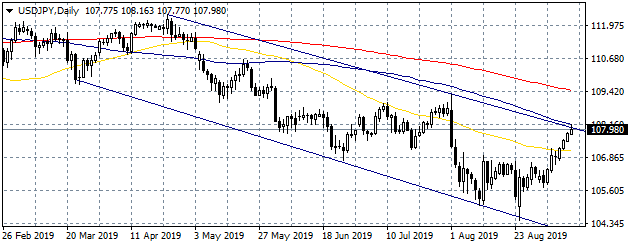

On the technical side, USDJPY continues higher for seventh consecutive trading session as the rebound which started in August 26th from 104.44 lows stalled today at 108.17 the 100-day moving average. The pair today managed to breach the descending trendline from April 2019 which stands around 108. On the upside first resistance stands at 108.16 the daily high, a convincing break above will attract more bids that can drive the prices up to 109.49 the 200-day moving average. Long positions can sit comfortably as long as the pair holds above 108 for a break above the 100-day moving average, stop-loss orders must be placed at 107.77 as if the pair breaks below, offers will step in and might push the price down to 107. On the downside, immediate support for USDJPY stands at 107.77 today’s low while extra bids will emerge at 107.48 yesterday’s low. USDJPY technical picture is neutral now as the pair trades above the 50-day moving average and tests the descending trendline. Bulls will take the upper hand if the pair closes above this hurdles.