- Summary:

- USDMXN gives up 0.01% at 19.5319 as recent retracement from yearly highs continues. Mexico Core Inflation came in at 0.2%, topping forecasts of 0.19%

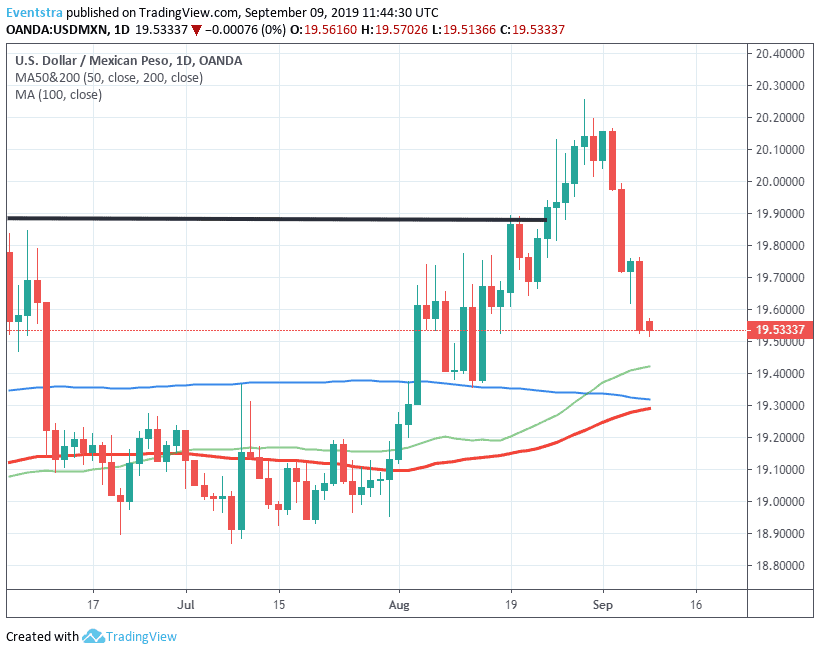

USDMXN gives up 0.01% at 19.5319 as recent retracement from yearly highs continues. Mexico Core Inflation came in at 0.2%, topping forecasts of 0.19% in August, the 12-Month Inflation came in at 3.16%, below forecasts of 3.2% in August. The Bank of Mexico cut interest rates for the first time since 2014 by 25 basis points to 8%. I believe that Banxico will continue in that direction with two more rate cuts before the year end.

On the technical side the momentum is neutral for the short term as the correction continues, but USDMXN trades above all major daily moving averages and above the 100-hour moving average. On the upside, first resistance stands 19,5702 today’s high then at 20.00 high from September 4th, while more offers will emerge at 20.2573 the yearly high. On the downside immediate support for the pair stands at 19.5136 today’s low and then at 19.4230 the 200-day moving average.