- Summary:

- The Taylor Wimpey share price has jumped 3.5% in Monday's trading session. Is the recovery move now in place?

After a muted start to the week’s trading, the Taylor Wimpey share price activity has increased significantly in the last thirty minutes. Bullish demand has driven the stock 3.5% higher as of writing. This performance has taken it into the top 5 gainers’ chart.

Recently, the stock has struggled to please despite stellar full-year earnings as more robust demand for homes and a 47% rise in home completions in the UK brought good business led to better-than-expected numbers. As a result, earnings had grown by £0.062 per share in 2020 to £0.152 per share in 2021. Revenues had met expectations at £4.28 billion, up from £2.79 billion.

However, there is the possibility of a better performance by the Taylor Wimpey share price. The company wants to pay a dividend of £0.0444 per share, improving over the £0.0414 per share dividend paid in 2020. The dividend will be paid to shareholders on the company’s register as of 1 April. The company also expects to complete a £150m shares repurchase program by 3 June.

Taylor Wimpey Share Price Outlook

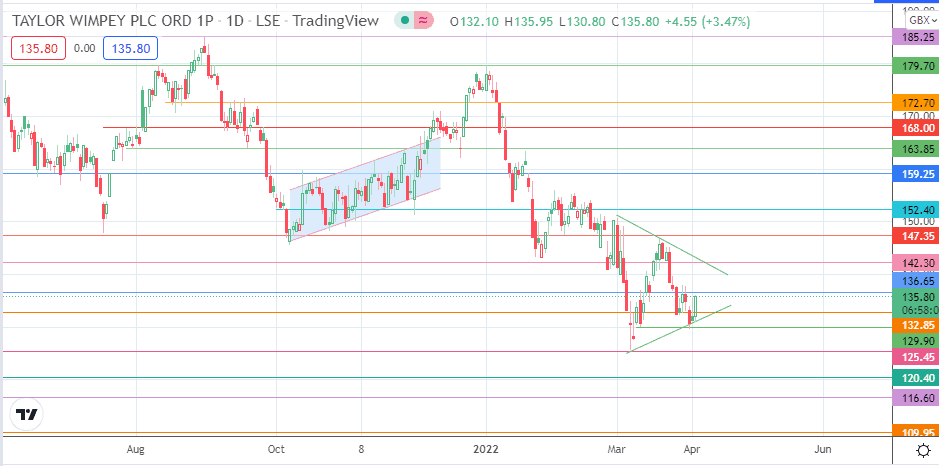

The Taylor Wimpey share price action is testing the resistance at 132.85 (). This follows the bounce off the lower border of the symmetrical triangle. If this resistance is broken, the 136.65 barrier (11 March high) comes in as the new resistance level.

To complete the triangle, the price must advance beyond this point and break the 142.30 resistance barrier. This scenario would open the door for a potential measured move towards 159.25. This makes 147.35 and 152.40 (18 November 2021 and 21 January 2022 highs) targets along the way that must be taken out for the measured move to be achieved.

On the flip side, a breakdown of the triangle’s lower border and the 129.90 support (10 March and 31 March lows) confirms the triangle as a bearish continuation pattern. This scenario sets up 14 September 2020 and 27 October 2020 low at 109.95 as the completion point of the measured move to the south. Fulfilment of the measured move requires the bears to degrade sequential support levels at 124.45 (7 March low), 120.40, and 116.60 (29 July 2020/11 August 2020 lows).

Taylor Wimpey: Daily Chart

Follow Eno on Twitter.