- Summary:

- US ISM Non-Manufacturing PMI beats market expectations as economic activity picks up in services sector. Data triggers selloff in gold and USD demand.

The ISM’s Non-Manufacturing PMI for August posted an upside surprise as it improved to 56.4 as against the figure of 54.0 that analysts had predicted.

This report along with the better-than-expected ISM Manufacturing data released some days ago, are proof that economic activity in both the manufacturing and service sectors in the US have started to pick up once more.

This news was enough to push the US Dollar Index off its weekly lows of 98.09 up to the 98.20 mark. It also provided further drive to the USD in its pairings with the Yen and the Euro. The USDJPY has also been able to test the 107.24 resistance, while the EURUSD has pushed off intraday highs and is now trading at 1.10482 (as at the time of writing).

The positive news for the USD on the day has proven to be the trigger for gold sellers to kick into action. Gold is inversely correlated with the USDJPY, as it shares safe-haven status with the Yen.

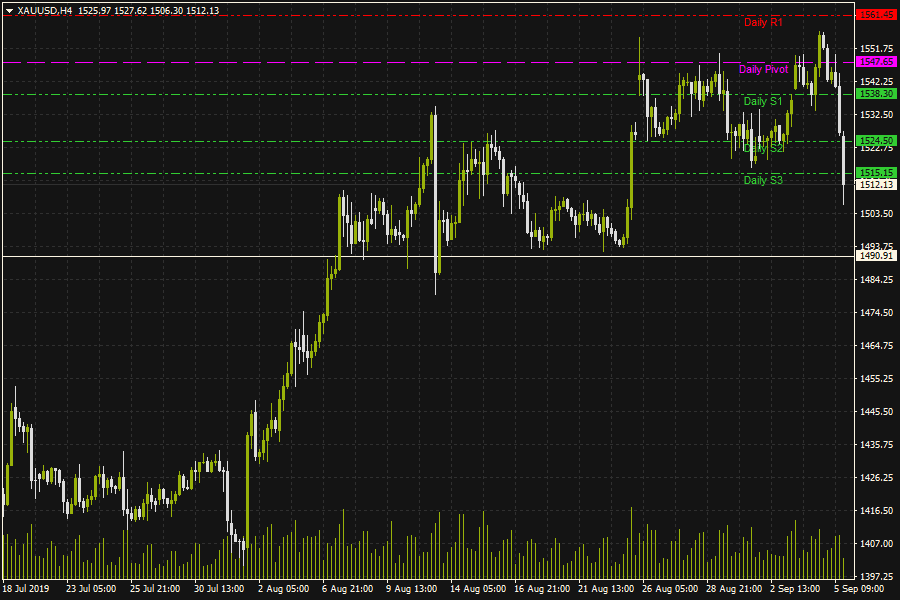

Gold, which has largely traded in an uneventful range all week, has sold off from intraday highs of 1556.68 and is now trading at 1515.15, after bouncing off the R3 pivot for the day. If gold pushes below 1515.15, the August lows of 1490 will come into focus.

If gold is able to maintain the bounce from R3, this could allow the yellow metal to test 1524.50 and above that level, 1538.30. Price action will also be influenced by tomorrow’s NFP report.