- Summary:

- USDMXN giving up 0.15% at 20.0796 in a correction that starte after the pair hit fresh yearly high at 20.2523 after the United States Gross Domestic Product

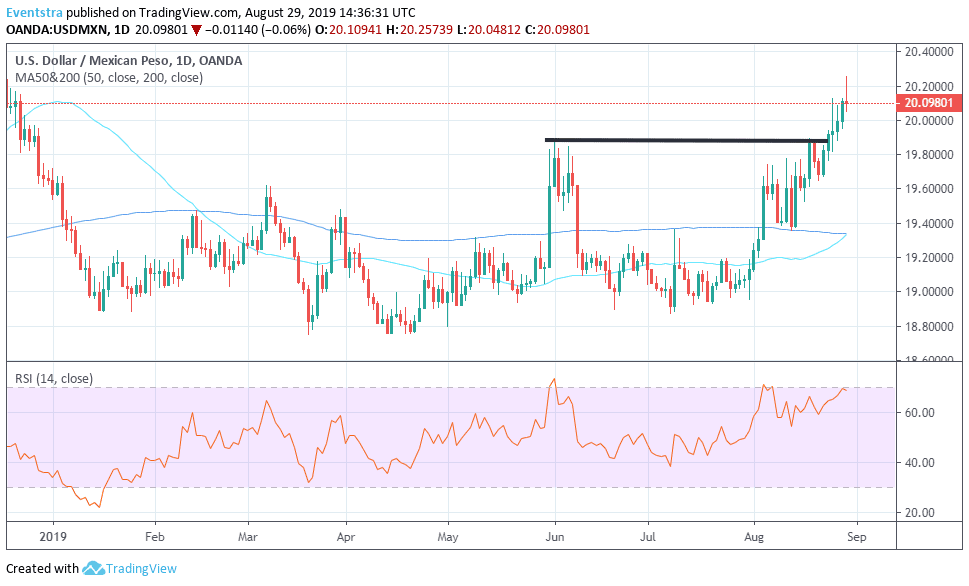

USDMXN giving up 0.15% at 20.0796 in a correction that started after the pair hit fresh yearly high at 20.2523. In macro data, the United States Gross Domestic Product Annualized came in at 2% in line with expectations for 2Q, 2019. The Initial Jobless Claims came in at 215K matching forecasts for August 23, the Continuing Jobless Claims came in at 1.698M, topping forecast of 1.68M on August 16. The United States Gross Domestic Product Price Index came in at 2.5% beating expectations of 2.4% in 2Q. The US Pending Home Sales (month over month) came in at -2.5%, below forecasts of 0% in July. Last week the Bank of Mexico cut interest rates for the first time since 2014 by 25 basis points to 8%. I believe that Banxico will continue in that direction with two more rate cuts before the year-end.

On the technical side, the bulls are in control making fresh YTD high trading above all major daily moving averages. On the upside first resistance stands at 20.2573 the daily and yearly high. Extra offers will emerge at the 20.61 the high from November 226th 2018. On the downside, immediate support for the pair stands at 20.0481 today’s low and then at 19.3557 the 200-day moving average; Long positions sit comfortably as long as the pair holds above 20.00.

USDMXN: Hits Fresh Yearly Highs, and Retreats

USDMXN: Hits Fresh Yearly Highs, and Retreats