- Summary:

- The EIA Crude Oil Inventories report is out in 30 minutes. Check out the technical levels ot watch out for when trading WTI crude oil.

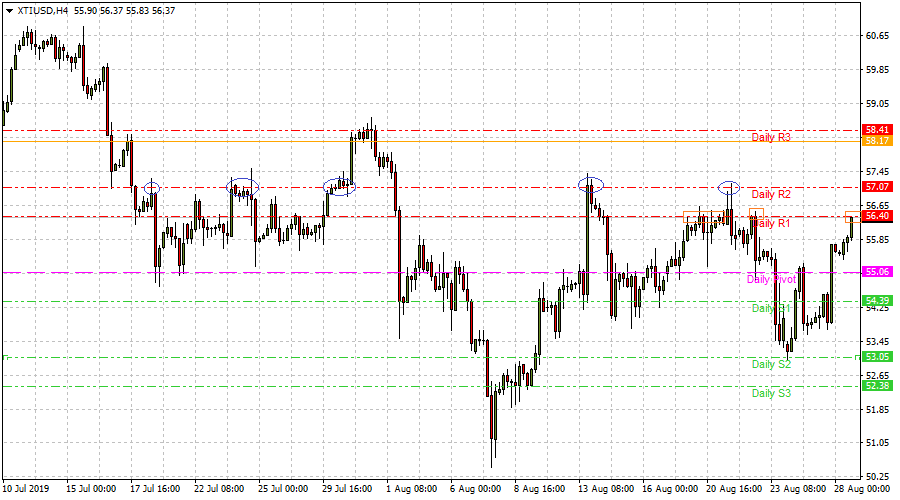

WTI crude oil is sharply higher and is currently trading at 56.40 ahead of the weekly EIA Crude Oil Inventories report. The market consensus for today’s report is for an increase in supply shortfalls to 2.8 million bpd, which would be higher than last week’s figure of -2.7m bpd.

Aside this report, the price of WTI crude oil has been dominated by the goings-on in the US-China trade impasse, with the commodity markets responding alternately to risk-on/risk-off sentiments that have pervaded the market in the last two weeks.

Technical Play on WTI Crude Oil

WTI crude oil is currently testing the resistance at the 56.40 R1 pivot. However, a look at the price action on the charts would suggest that the 57.07 R2 pivot has been a stronger resistance than R1, given the number of times this price level has been tested in the past without being broken. Therefore, WTI crude oil is expected to encounter significant headwinds at the 57.07 price level.

If WTI crude oil is able to breach the 56.40 price level, this will open the way to the 57.07 resistance; a price level which was last breached in the last week of July. Beyond this price level, 58.41 lies ahead as the next resistance point, if price is able to break above 57.07.

If the price fails to breach 56.40, then the door will be open for a retest of 55.06. Below this area, the downside targets remain 53.90 and 53.05, and could be attained if a risk-off sentiment takes hold of the market once more.