- Summary:

- The Aussie Dollar took a plunge in Asian trading as RBA Deputy Governor sparks rate cut expectations with dovish comments.

Asian shares surged today on the renewed optimism of a positive outcome over the US-China trade impasse, given the positive comments from US President Donald Trump and the Chinese Vice Premier Liu.

But the main news out of today’s Asian trading were the comments of the Deputy Governor of the Reserve Bank of Australia, Guy Debelle. Debelle was quoted in a news report as saying that the floor for the cash rate of the RBA was likely to be around 0% – 0.5%. Even though he attempted a walk back on those statements by saying that he hoped that the interest rate would not be set that low by policy makers, the markets were spooked enough to initiate a sell-off of the Aussie Dollar.

Technical Plays for the Australian Dollar

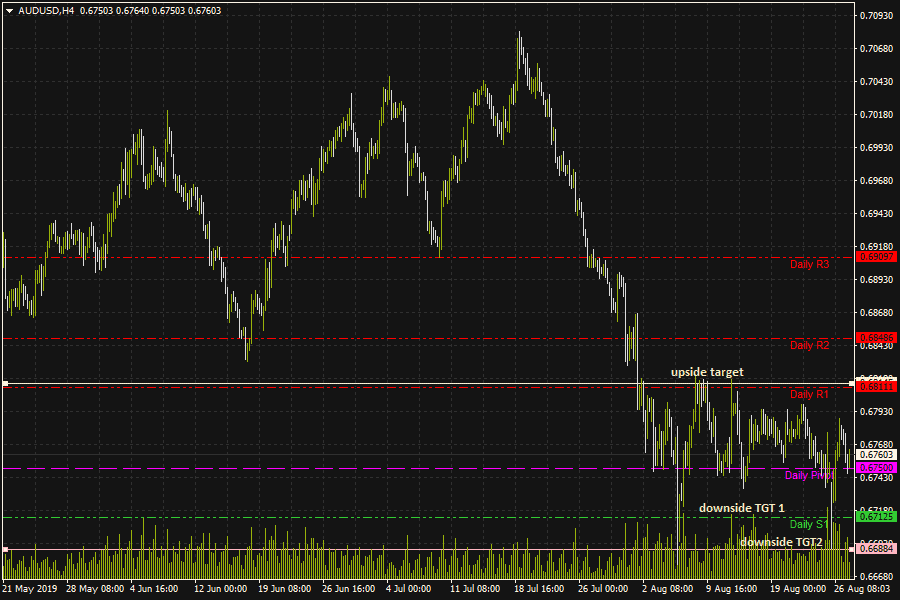

The Australian Dollar is currently trading at 0.6746, having recovered from Monday’s low of 0.6688. In the absence of any major news releases from China and Australia this Tuesday, the technical support/resistance levels are provided near-term by the pivot points.

Immediate support is seen at 0.6750 (central pivot and lows of Aug 7 and Aug20). A downside break of this support will target 0.6712. To the upside, the near-term resistance is found at 0.6795-0.6799 (Aug 16 and Aug 21 highs). A break above this price area could possibly send the pair to the price area that lies between 0.6811 (R1 pivot) and 0.6822 (August 8 and August 13 highs).