- Summary:

- GBPCHF experiences massive selloff on the back of safe-haveb buying, as poor UK GDP adds to the woes of the British Pound

The British Pound sold off against the Swiss Franc on the back of more safe-haven buying, on the back of poorer-than-expected GDP results from the United Kingdom. The UK GDP came in at 1.2%, which was lower than the market consensus of 1.4%. This preliminary GDP results adds to the woes experienced by the British Pound over the last 2 trading weeks and it looks like the British Pound is going to have worse days ahead.

Technical Plays for GBPCHF

The Swiss Franc is traditionally a safe haven asset which attracts demand during times of global economic upheaval. As a result, the no-deal Brexit scenario which has weighed on the British Pound in the past two weeks has presented an opportunity to short the GBPCHF pair. The pair has fallen a colossal 1,652 pips since the end of April and with this latest GDP reading, the GBPCHF is expected to fall even further.

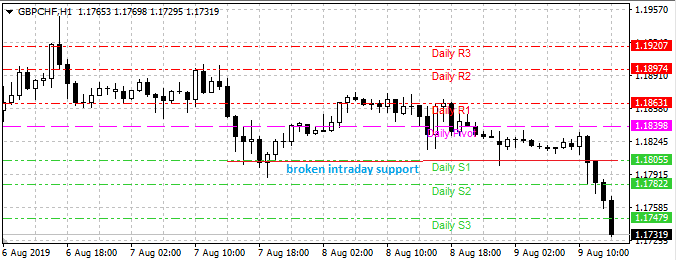

The intraday chart reveals that the GBPCHF has broken the 1.18055 intraday support (S1 pivot) and has romped through the S2 pivot support as well. The pair is now testing the S3 pivot at 1.17479.

A downside break of this level will open the door to the 1.14478 price level, which has only been seen once since retail forex was introduced in 1997, and that was the 2011 low. Traders are advised to sell on possible rallies to the 1.1805 broken intraday support (now resistance), or 1.1839 and 1.1863 price areas.