- Summary:

- The Nasdaq 100 index faces further tests to its ascent as employment data and a key Fed inflation index are due for release this week.

The Nasdaq 100 index futures are trading higher this Monday, pointing to a higher open for the week. However, the Nasdaq 100 is trading close to a resistance level and could face a stiff test at this level. The upside move seen in recent weeks follows the risky appetite for technology stocks and the Chinese government’s pledge to support local Chinese tech companies listed abroad (including the Nasdaq).

This has produced a demand for shares listed on the index, even after the Fed started its rate tightening cycle. On the fundamental scene for the week, a slew of employment data (JOLTS Job Openings, ADP Employment Change and the Non-Farm Payrolls) and the Fed’s key inflation index (Core PCE Price Index m/m) will be the most important triggers for the US markets.

With no progress in resolving the Russia-Ukraine conflict, geopolitical factors also remain at the back of the minds of traders heading into the new month. As of writing, the Nasdaq 100 index futures were trading higher by 0.59%.

Nasdaq 100 Index Outlook

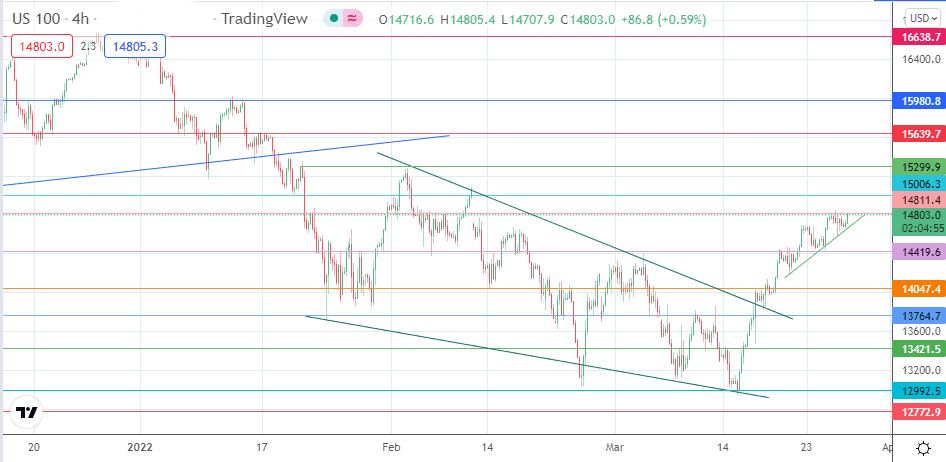

The breakout move from the falling wedge on the daily chart is expected to meet a stiff test at the 14811.4 resistance. This is the last hurdle the bulls need to overcome to push the measured move to its conclusion at 15006.3. If the bulls reach this target, the market would need an extra push to aim for 15299.9 (20 January 2022 high) or 15639.7 (16 January 2022 high).

On the flip side, a rejection at the 14811.4 resistance truncates the measured move and could spur some profit-taking that sends the price activity towards the 14419.6 support mark (4 February and 24 March 2022 lows). However, this move will only occur if the short trendline that connects recent lows at 21,24 and 28 March 2022 is taken out. Below the 14419.6 support, 14047.4 and 13764.7 price levels constitute additional southbound targets, with 13421.5 entering the picture only if there is a steeper correction.

Nasdaq 100: 4-Hour Chart

Follow Eno on Twitter.