- Summary:

- What is the outlook of the peso to dollar exchange rate in the next few years to 2025? We explain whether the pair will keep rising.

Table of Contents

The USD/MXN pair has been struggling in the past few weeks as investors focus on the soaring crude oil prices and the actions by the Federal Reserve and Mexico’s Banxico. As a result, the dollar to peso is trading at 20.95, about 2.45% below the highest level this month. Still, the price is about 4% above this month’s lowest level.

Table of contents

USD/MXN relationship explained

The US and Mexico are two of the closest trading partners globally. In the past two decades, the North America Free Trade Agreement (NAFTA) has pushed more companies from the US to Mexico in search of low wages. For example, automakers that dominated places like Detroit have established large plants in Mexico.

This trend will likely continue even with the Trump-negotiated USMCA agreement. According to the USTR, the two countries do trade worth over $614.5 billion every year. Of these, the US exports goods worth $256 billion and then buys $358 billion. As a result, it has a massive trade deficit of over $101 billion.

Therefore, this trade makes the Mexican peso one of the world’s leading emerging market currencies. Moreover, among other EM currencies, Mexico is the one that has a close correlation with the United States. This means that its currency tends to do well in a period when the American economy is flourishing. For example, in the past two years, the Mexican economy has outperformed other EM countries because of the vast fiscal stimulus in the United States.

Crude oil prices and the Mexican peso

Another key factor that tends to impact the dollar to peso pair is crude oil prices. Mexico is a leading producer of crude oil and sells about $26.6 billion of the commodity every year. As a result, the country tends to do well when oil prices rise, leading to more foreign exchange. While the US is the biggest oil producer globally, it consumes most of its oil and exports just a small amount.

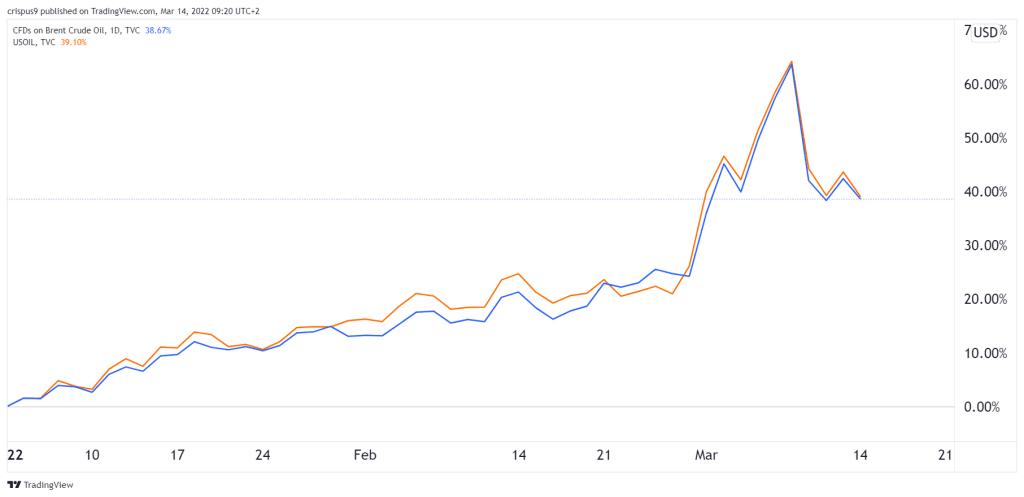

Therefore, the Mexican economy is expected to benefit as oil and gas prices soar. Brent, the international benchmark, is trading at $115, which is a 60% increase in the past 12 months. In addition, Brent and West Texas Intermediate (WTI) have risen by over 40% year-to-date.

Federal Reserve actions

The next key mover for the peso to dollar pair will be the upcoming actions by the Federal Reserve. The Federal Open Market Committee (FOMC) will start its two-day meeting on Tuesday this week and then deliver its decision on Wednesday. Analysts expect the bank to start hiking interest rates and end its quantitative easing policy this week even as the risk of the Russian invasion of Ukraine rise.

Recent data seem to support the need for a hawkish Fed. For one, America’s inflation has surged to the highest level in over 40 years. In February, the headline inflation rose to 7.9%, while the core CPI rose to 6.4%. The latter figure excludes the volatile food and energy products.

And many analysts believe that inflation is worse than what the official numbers state. For example, prices of key items that Americans regularly use, such as rent, new and used cars, and air tickets, have jumped sharply in the past few months. The situation is likely to worsen after the Russian invasion of Ukraine, which has pushed prices of key commodities like copper, coal, nickel, and aluminium significantly higher.

Banxico to follow?

The USD/MXN is reacting to potential actions by the Mexican central bank, commonly known as Banxico. Like other emerging market central banks, the bank has embraced a relatively hawkish tone as officials attempt to battle the rising inflation. It has delivered two straight rate hikes in a bid to deal with the soaring inflation that stands at 7%. They have hiked rates by 200 basis points since last year. Other banks like those in Brazil and South Africa have also hiked rates.

Recent data show that the Mexican economic recovery is slowing. For one, the US has not implemented the substantial stimulus packages it delivered in 2021. In addition, it only passed a large infrastructure package to be implemented in 10 years. Therefore, the impact of the infrastructure package on the Mexican economy will be limited.

USD/MXN forecast 2022

The main catalyst for the USD/MXN pair in 2022 will be the actions by the Fed and Banxico. However, it will also be influenced by geopolitics. In the past few weeks, Russia has intensified its shelling of Ukraine, leading to thousands of deaths. As a result, the dollar index has jumped because of the safe-haven characteristics of the greenback. As the crisis escalates, there is a likelihood that the peso to the dollar exchange rate will keep rising.

At the same time, the signals and actions by the Federal Reserve will have an impact on the pair. If the bank signals that it will accelerate its rate hikes, it will lead to more demand for the US dollar. In this case, the actions of the Mexican central bank will not have any major impacts.

Peso to dollar 2022 technical analysis

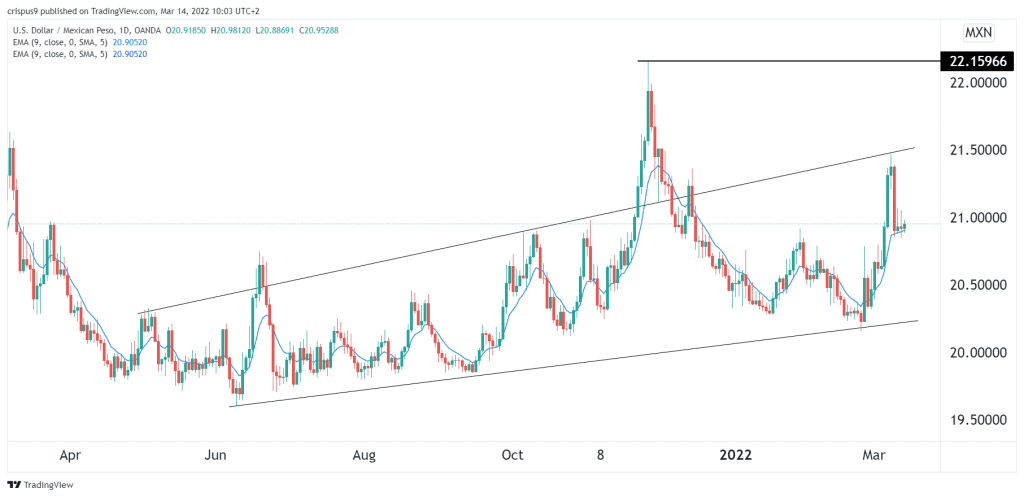

The daily chart shows that the peso to dollar pair rose to a high of 21.46 this month. This was a notable price since it was the highest point it had been since December last year. It was also along the upper side of the ascending channel.

Recently, it has moved slightly lower as investors focus on the rising crude oil prices. Still, with the Fed set to embrace a more hawkish tone, the pair will likely keep rising in 2022. If this happens, the next key level to watch will be at 22.15, which was the highest point in 2021.

USD/MXN 2025 forecast

The weekly chart shows that the USD/MXN pair has been in a bullish trend in the past few years. It has risen by over 75% from its lowest level in 2014. This means that the possibility is that it will keep rising in the next few years to 2025. Therefore, using the Andrews Pitchfork tool, we can assume that the pair will rise to above 25 in 2025.