- Summary:

- What is the outlook of the Roblox stock price after it has crashed hard lately? We explain what to expect in the near term.

Table of Contents

The Roblox stock price has lost its shine in the past few months. The RBLX shares are trading at $41.87, which is the lowest it has been on record. In addition, this price is about 70% below its all-time high, bringing its total market cap to about $24 billion, significantly lower than its all-time high of almost $50 billion.]=

Table of contents

What is Roblox?

Roblox is a leading technology company that is in the metaverse space. The company offers a platform where people build games while others play them. As a result, it is considered one of the biggest companies in the metaverse industry.

Roblox is also seen as one of the leading companies that benefited from the Covid-19 pandemic as most people stayed at home. During this period, many students around the world stayed at home engaged with their mobile and desktop gadgets.

Roblox is an extremely popular platform with almost 50 million daily active users from around the world. In total, these users stay on the platform for over 10 billion hours every quarter.

Why Roblox stock has crashed

There are several reasons why the Roblox stock price has crashed hard in the past few months. First, the decline is mostly because of the ongoing rotation from lockdown stocks to reopening ones. Most stocks that did well during the pandemic have sold off.

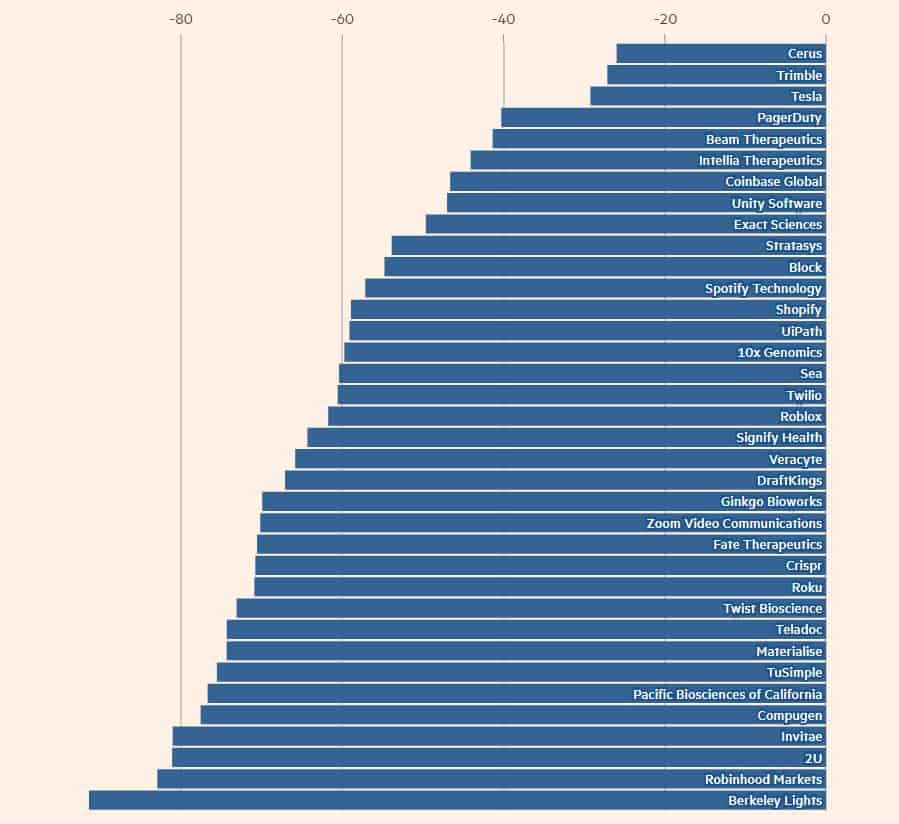

A good example of this is Cathie Wood’s Ark Innovation Fund, which has crashed by over 62% from its highest point in 2021 and is trading at the lowest point since June 2020. This ETF is made up of some of the top companies that shone during the Covid-19 pandemic, like Teladoc, Shopify, and Spotify.

Second, the RBLX stock price has crashed because of the company’s decision to exit the Chinese market earlier this year. The firm said that it shut its iOS and Android apps in January in a bid to work on a new one. Therefore, the exit from a country with over 720 million gamers has pushed many investors away from the company.

Third, Roblox recent earnings missed the analysts’ forecasts by a wide margin. Its revenue of $770 million was lower than expectations by about $5.85 million. Similarly, its loss per share of 25 cents was lower than what analysts expected.

Additionally, the Roblox stock price has retreated as the earlier excitement about the metaverse evaporates. Indeed, the most metaverse cryptocurrencies like Axie Infinity, Decentraland, and The Sandbox have all crashed by more than 60% from their highest levels on record.

RBLX analysts forecasts

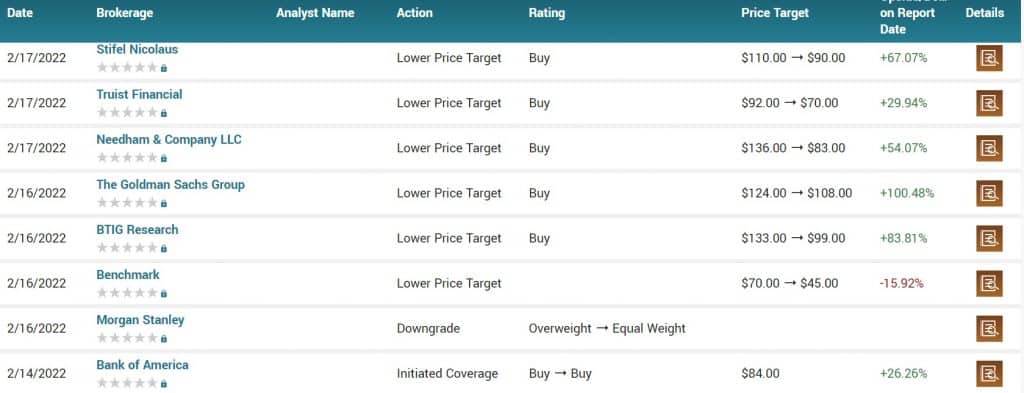

The RBLX share price also crashed because of renewed worries from sell-side analysts. In the past few months, most analysts following the company have lowered their target because of the expected slow growth.

For example, as shown below, analysts at Stifel Nicolaus lowered their target from $110 to $90 while those at Truist lowered it from $92 to $72. Others who have lowered their expectations are from Needham, Goldman Sachs, BTIG, and Morgan Stanley. Historically, stocks tend to disappoint when analysts are downgrading them.

Still, a closer look at the estimates show that they expect that the stock will still move above where they are today. For example, Goldman Sachs analysts believe that it will still rise to $108.

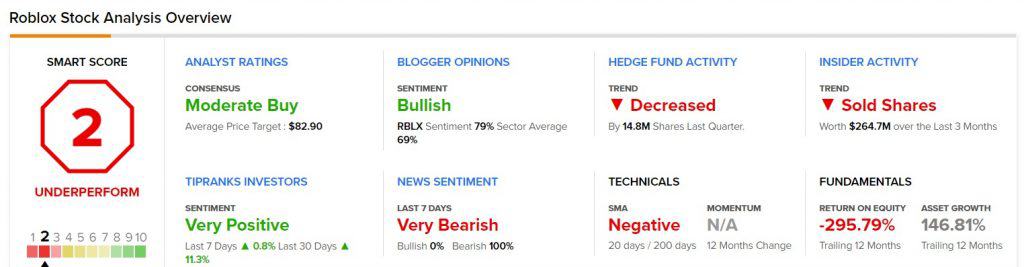

Meanwhile, Roblox has a smart score of 2, which is underperform in Tipranks. Data compiled by the site shows that the stock is a moderate buy with an average target of $82.90. This sentiment comes from the fact that the company’s news sentiment has been negative while hedge funds have been reducing their stake.

More reasons why the Roblox share price has tumbled

There are more reasons why the stock has fallen. For example, as a growth stock, the company is highly vulnerable when the Fed is about to tighten, And recent data show that the Fed will ultimately embrace a more hawkish stance since the unemployment rate has dropped while inflation has surged to a multi-decade high of 7.5%. Therefore, we have seen a rotation from growth companies to value.

The other reason why the Roblox stock price has collapsed is that insiders have been selling the stock. In the past three months, they have sold shares worth over $264 million. This is usually interpreted as a sign that they are losing confidence in the company.

Is Roblox a good investment?

A case can be made for investing in Roblox for long-term investors, which explains why Cathie Wood has been accumulating the shares. The company is highly addictive and has millions of users, most of who are always ready to spend in the network.

Since the company has about 150 million monthly users, the valuation means that each user is worth about $133. This is a relatively affordable valuation.

At the same time, the company has seen its revenue growth accelerate from about $325 million in 2018 to over $1.9 billion in 2021. This is an impressive growth that will continue. Further, Roblox has more room to grow especially in brand advertising.

Roblox stock price forecast for 2022

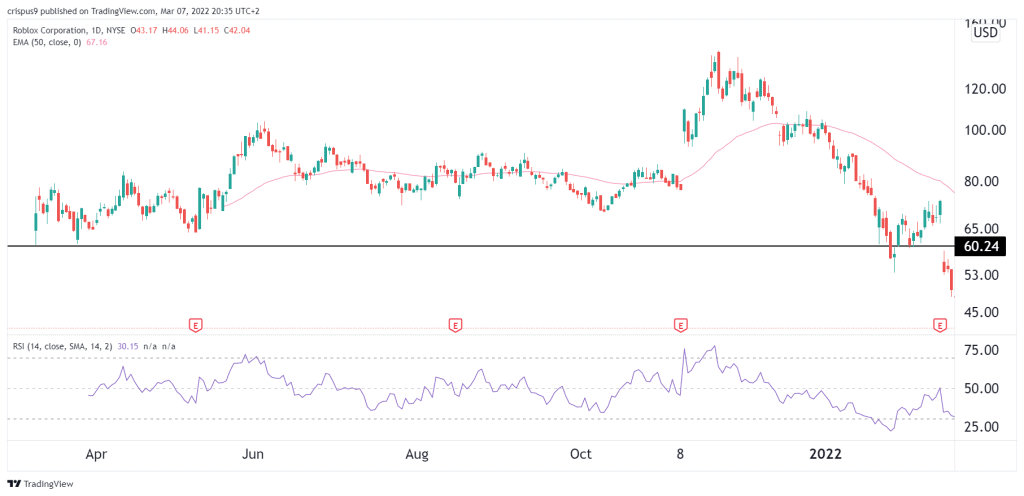

The daily chart shows that the Roblox stock price has been in a deep sell-off in the past few months. The sell-off accelerated when the stock moved below the support at $60.25, which was the lowest level in March 2021.

Along the way, the RBLX stock price has crashed below the 25-day and 50-day moving averages while oscillators like the Relative Strength Index (RSI) and Stochastic have moved below the oversold levels.

Therefore, there is a likelihood that the Roblox stock will continue falling in the near term as bears target the next key level at $30. In the long-term, however, I suspect that the stock will ultimately rebound.

Summary

Roblox is an excellent metaverse stock that has been in a strong bearish trend. In this article, we have looked at the reasons why the stock has crashed and explained some of the reasons why it could come back to life in the near term.