- Summary:

- Rising crude oil prices which are now close to 8-year highs, are keeping the Shell share price on the bullish path

The Shell share price surge continued in Monday’s trading session, hitting gains of 1.65%. This is a continuation of the fallout of rising energy prices across the world as crude oil prices approach 8-year highs.

Shell is also preparing to step into the opportunity that would exist when China opts out of its famed thirst for fossil fuels, as it says that electricity would amount to 60% of China’s energy use by 2060. The company is a major investor in China’s energy sector, giving it a ringside seat to opportunities that stem from this energy transition.

Shell is preparing to receive payment and hand over the Deer Park refinery to Petroleos Mexicanos this week, after selling its majority stake in May 2021 to Pemex for $596million.

Shell Share Price Outlook

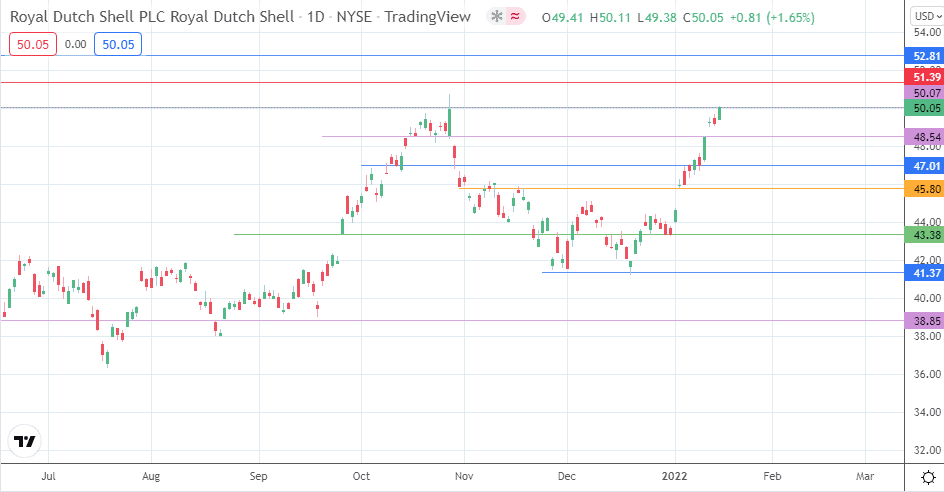

The price action is now testing the 29 February 2020 high at 50.07. if the bulls uncap this resistance level, the journey towards the 51.59 barrier (13 February 2020 high) is shortened. Above this level, 52.81 steps into the picture as an additional target to the north.

On the flip side, rejection at 50.07 could allow the bears to initiate a correction. This corrective move would have as initial targets 45.80 and 43.38. There is the potential for 47.01 (the 8 October 2021 and 5 January 2022 highs) to serve as a potential pitstop before the correction continues.

Shell: Daily Chart

Follow Eno on Twitter.