- Summary:

- The AAVE price has spent the last two weeks consolidating above $150 as the token attempts to reverse a four-month bear market.

The AAVE price has spent the last two weeks consolidating above $150 as the token attempts to reverse a four-month bear market.

Aave (AAVE), the former leading Decentralized Finance (DeFi) protocol, has fallen from grace in the last few months. The price and the Total Value locked (TVL) have declined steadily, despite the overall Defi market growing to almost $250 billion. Since August, the AAVE token has lost nearly 60% of its value, hampering network growth and utilization. As a result, Aave has fallen to fourth place in the DeFi rankings.

Aave’s fundamental issues come at the wrong time for the protocol. The cryptocurrency market as a whole has turned lower in recent weeks, losing around $800 billion in market cap since November. Subsequently, several poor-performing tokens have erased most of the gains made in 2021. Furthermore, despite the low price, AAVE could get cheaper still.

Price Forecast

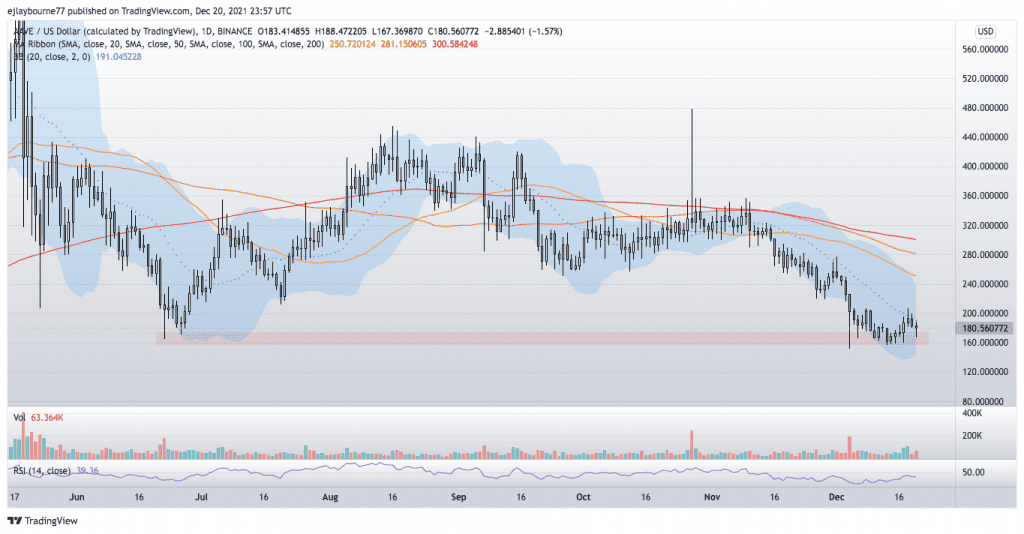

The daily chart shows the Aave price is finding support around the $150 mark. However, the token struggles to advance beyond $200, indicating overhead selling.

The danger for Aave is if it falls below $150. In that event, the token may decline towards December 2020 high’s around $100. Considering the weakness of the token and the broader market, a $100 price is possible in the coming weeks. However, climbing above the November 28th low would be constructive. Therefore, a daily close above $244.80 invalidates the bearish view.

Aave Price Chart (daily)

For more market insights, follow Elliott on Twitter.