- Summary:

- The S&P 500 index opened sharply lower, but has pared some of these losses as the markets digest the hawkish outlook of the Fed.

The S&P 500 index started the day’s trading session sharply lower but has been able to pare some of these losses as the markets prepare for the Christmas holiday.

The US markets are still smarting from yesterday’s decline, which followed hawkish signals from the Fed about multiple rate hikes in 2022 to halt the inflationary trends, which have continued the buck the “transitory” narrative the apex bank has put out for several months.

In what may be an admission that its inflation outlook may have been flawed, the Fed says it will cut asset purchases by $30 billion a month starting in January 2022. Policymakers have also provided an outlook that suggests as many as three rate hikes in 2022 if consumer inflation continues to rise unchecked.

The Bank of England has already fired the first salvo from the G7 currency basket, raising interest rates from 0.1% to 0.25% to combat local inflation at multi-year highs.

S&P 500 Outlook

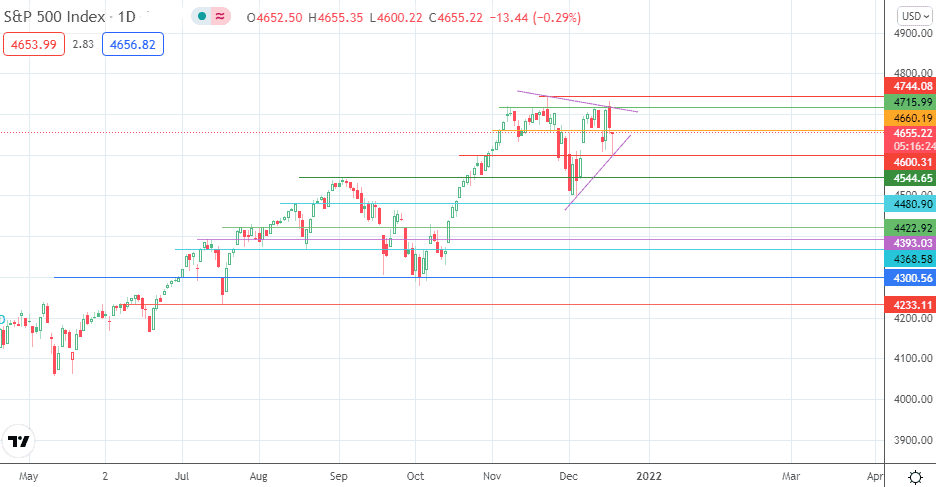

The bulls have rejected Friday’s decline at the 4600.31 support level. The rejection has put the active daily candle on course to retest the 4660.19 resistance mark. If the price breaks through this level to the upside, 4715.99 comes into view once more. The 4744.08 price mark remains the all-time high and the highest barrier of note.

On the flip side, a rejection of the intraday bounce on 4600.31 at the 4660.19 barrier allows for a retest of the former, leaving 4544.65 as the immediate downside target if the bears break down this area. 4480.90 and 4422.92 are additional downside targets if the correction on the index continues.

S&P 500 Index: Daily Chart

Follow Eno on Twitter.