- Summary:

- Clover health share price continues to face additional pressures as buyers fail to deliver any solid momentum to the stock since early November.

Clover Health is slightly higher this Friday, as bulls struggle to break the limitations imposed by the steep fall of the stock in November.

The Clover Health share price fell more than 33% in November alone, as costs per premiums earned rose 86.7% on a year-on-year basis to 102.5%. Despite the improved top-line numbers, investors will not be amused by any situation where a company is spending more than it earns.

The Clover share price continues to struggle to generate upside momentum, with only five winning sessions in eighteen, all with low trading volumes. The price is presently down 0.22% as of writing.

Clover Health Share Price Outlook

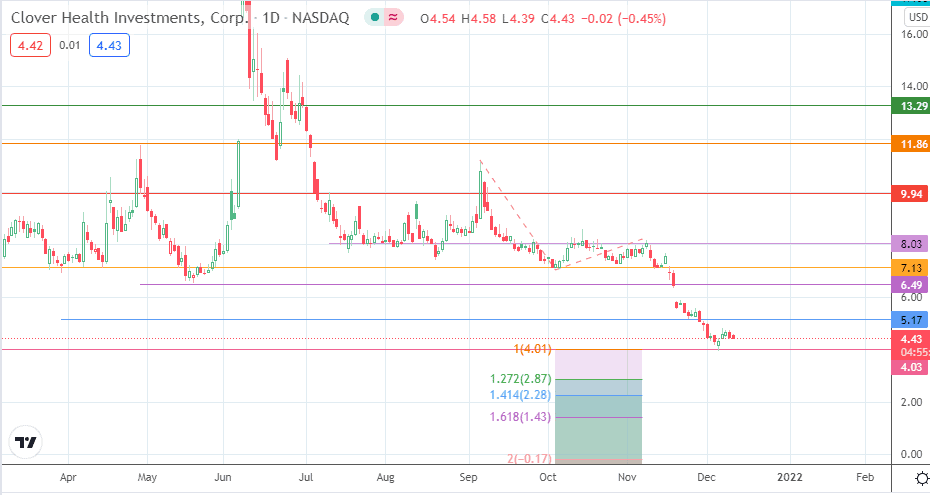

The price action is now trading in the range between 4.03 and 5.17. A break above 5.17 targets 6.49 (19 May and 17 November). 7.13 and 8.03 are additional price targets to the north if the recovery move is extensive.

On the other hand, a decline below 4.03 ushers in new lows, targeting 2.87 and 2.28 (141.4% and 161.8% Fibonacci extension levels) as potential downside targets. Otherwise, the price may keep trading in the range if the ceiling and floor of the range remain intact.

Clover Health: Daily Chart

Follow Eno on Twitter.