- Summary:

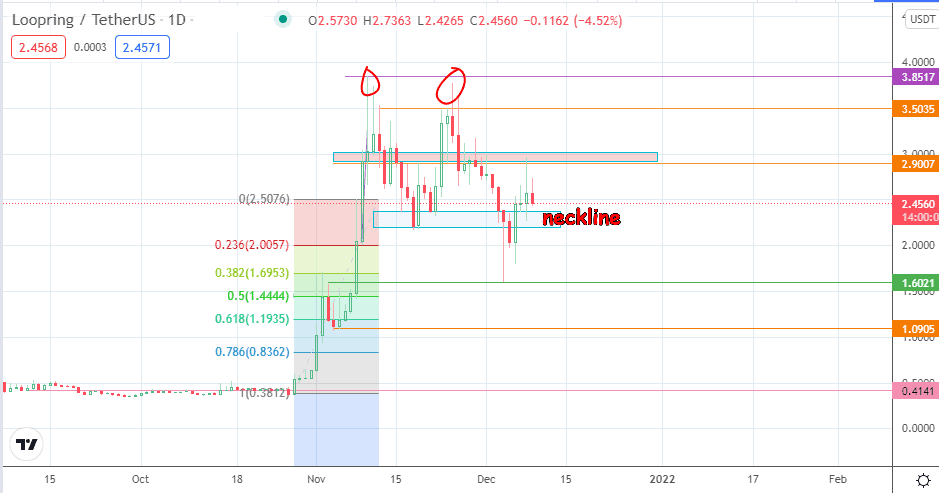

- The completion of the double top on the daily chart could signal a slide, upping bearish Loopring price predictions in the near term.

The Loopring price prediction for this Thursday depends on the price action at the support zone, which lies between 2.1931/2.3783. The bears rejected attempts to break the resistance zone between 2.9007 and 3.0231, setting the tone for Thursday’s decline.

The decline followed the rejection at 3.8517, forming an evolving double top. The break of the former support-turned-resistance zone, followed by the subsequent rejection, has put Loopring under pressure.

With the LRC/USDT pair now trading 4.52% lower, what is the Loopring price prediction heading into the weekend?

Loopring Price Prediction

The double top on the daily chart portends danger for the bulls, especially as the price is now challenging the support zone at 2.1931/2.3783. A breakdown of this zone allows the bears to aim for a measured move, expected to extend towards the 61.8% Fibonacci retracement mark at 1.1935. This move would need to take out the 4 December low at 1.6021 and the 50% Fibonacci retracement level at 1.4444 to be achieved. 1.0905 (4/5 November lows) is the next target if the projected price completion point from the measured move is exceeded.

This outlook is negated if the price action bounces from the support zone and takes out the resistance zone whose floor rests at 2.9007. If the resistance zone is breached totally, 3.5035 becomes the next target in line, before 3.8517 comes into the picture as the next target to the north.

LRC/USDT: Daily Chart

Follow Eno on Twitter.