- Summary:

- The acquisition of an EV charging station provider as part of the expansion into green energy could boost the BP share price.

In what constitutes a diversification move towards green energy, BP has acquired Amply Power in a strategic move to deploy 70,000 battery charging stations in the US. This represents a significant push to ramp up earnings from its convenience and mobility business, which earned the company $5m in 2019.

BP is looking to expand its charging stations in the UK after data showed that new electric vehicle registrations doubled in November on a year-on-year basis.

The BP share price is also responding positively to the news from Pfizer that the third dose of its vaccine was effective in neutralizing the Omicron variant of the COVID-19 virus. The stock is trading at a breakeven price of 348.60p as of writing.

BP Share Price Outlook

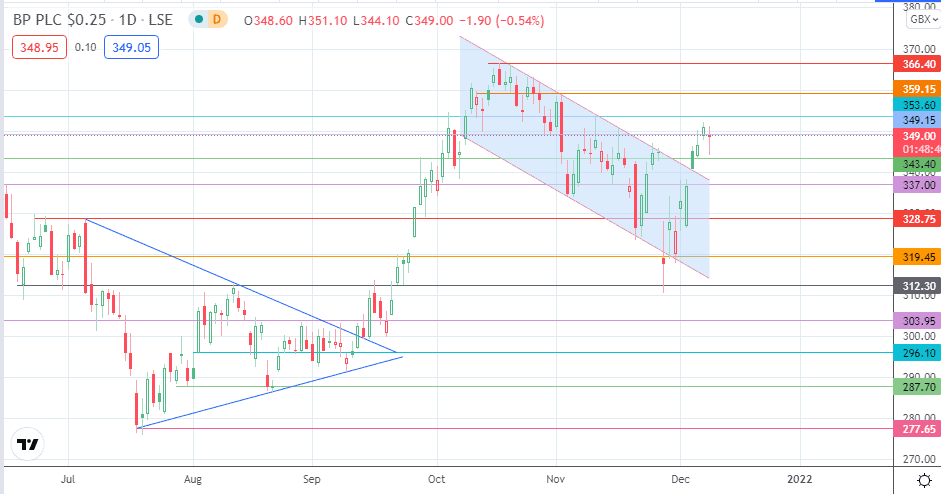

The price action is testing resistance at 349.15. A break of this level allows the bulls access to 353.60. An uncapping of this new resistance opens the door towards 359.15, with 366.40 coming into the mix if the advance continues as the price seeks completion of the break of the bullish flag.

On the other hand, rejection at 349.15 allows for a pullback towards 343.40. If the bulls fail to defend this support, 337.00 becomes the new target, followed in sequence by 328.75 and 319.45. A continuation of this corrective decline invalidates the bull flag’s breakout move, which is already in progress.

BP: Daily Chart

Follow Eno on Twitter.