- Summary:

- The DAX 30 bias is now upward and in line with the long-term bullish bias since the start of 2019, but will traders buy at current levels?

The DAX 30 is holding up well despite German Manufacturing PMI declining to 43.1 from 45, and lower than the 43.1 projected by economists. However, the Services PMI is holding up well at 55.4, and that might explain the resilience of the DAX.

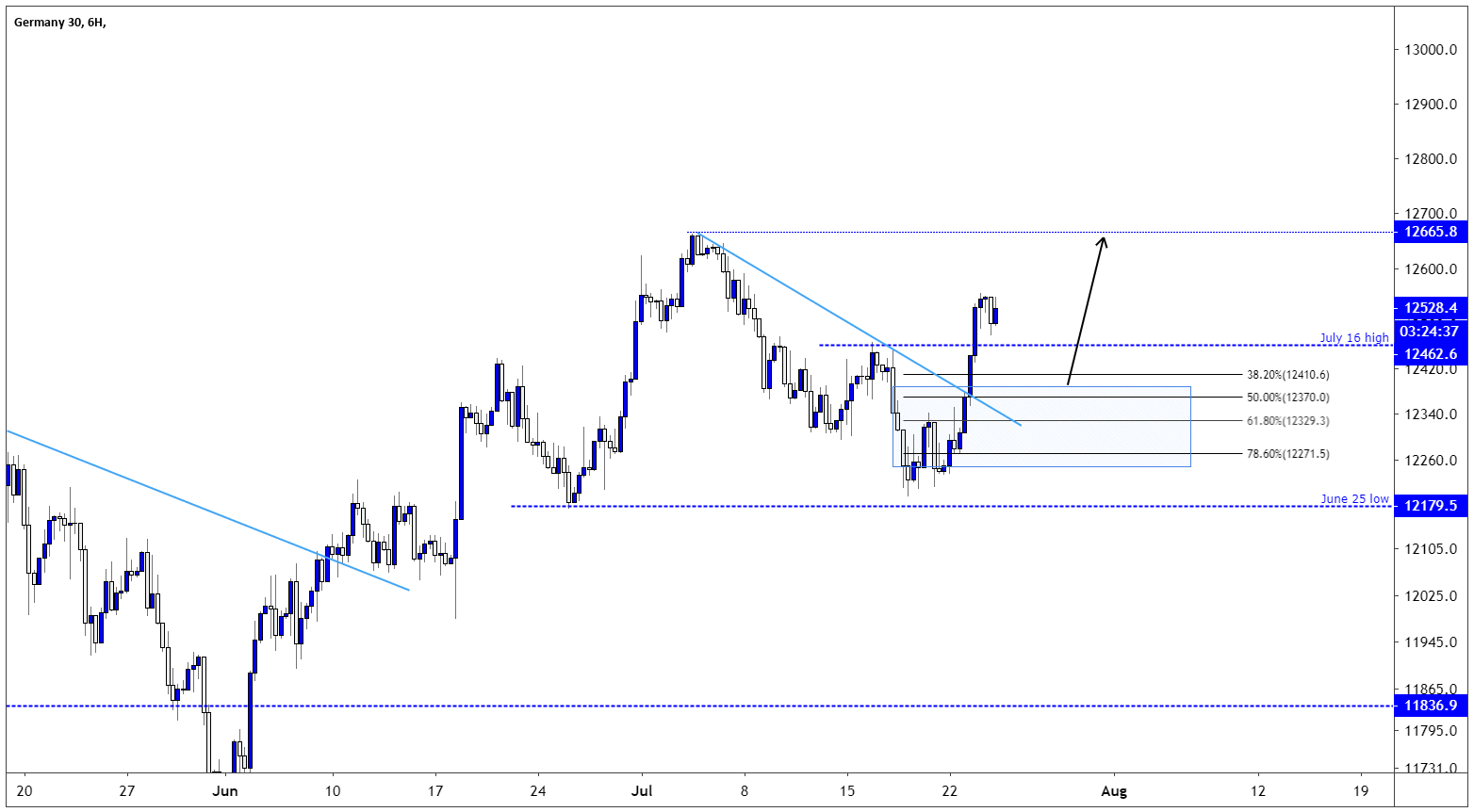

Yesterday, the stock index traded above the July 16 high and ended its short-term downtrend from the July 3 high of 12665. The bias is now upward and in line with the long-term bullish bias since the start of 2019. The trend will remain bullish as long as the price trades above the June 25 low of 12179.5, and I suspect that traders might buy a 50% correction of the rally from the July 17 low at 12196 to this week’s high. The 50% correction level is at 12370, and the reason for traders waiting for a correction is to improve their risk-reward ratio.

Facebook Earnings July 24: Download our free FB earnings preview report today.

Don’t miss a beat! Follow us on Twitter.