- Summary:

- The GlaxoSmithKline GSK share price will be in the spotlight on Monday as investors reflect on the company’s prospects for HIV treatment.

The GlaxoSmithKline (GSK) share price will be in the spotlight on Monday as investors reflect on the company’s prospects for HIV treatment. The stock declined to a low of 1,510p on Friday, which was about 6% below the highest level this year.

GSK has been under pressure in the past few months as the company’s management faces activist pressure. Elliot Management, an activist hedge fund, has called for major changes in the company. The company is already separating itself into two by spinning off its consumer-facing products. The remainco will focus on drugs and vaccines.

Today, the GSK share price will be in the spotlight as the company provides an update about its HIV cure. The firm will deliver a presentation where it will talk about the vaccine. According to Telegraph, the company is set to start human trials for its cure as soon as summer.

The announcement comes three weeks after the company announced that it received an approval for its long-lasting HIV drug. It also inked a 743 million pounds deal with the US about its Covid vaccine.

The HIV cure, if passed, will be the first known cure for a disease that affects more than 38 million people globally.

GSK share price forecast

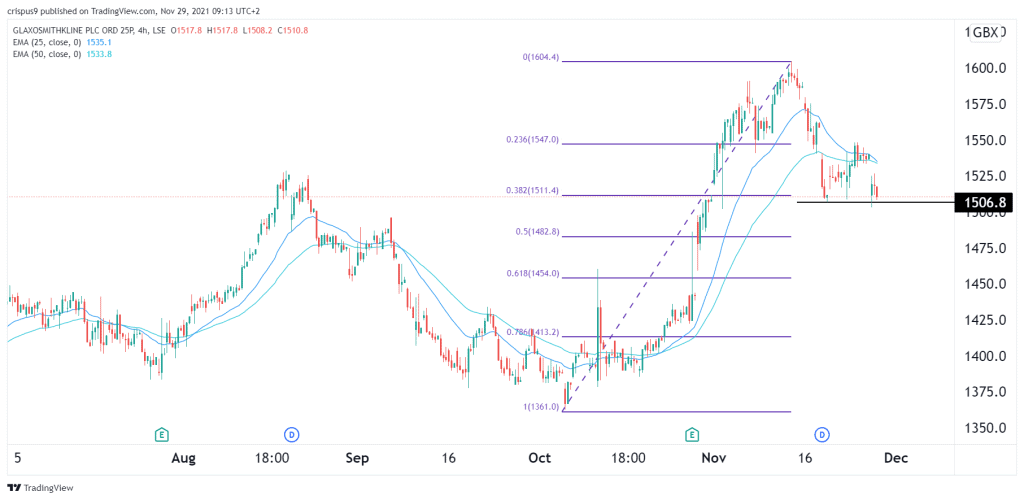

The four-hour chart shows that the GSK share price has been struggling lately. On Friday, the stock dropped to 1,510p. This was an important level since the stock has struggled to move below this level several times in November. The price was also along the 38.2% Fibonacci retracement level.

At the same time, the 25-day and 50-day moving averages. The two have even made a bearish crossover pattern.

Therefore, I suspect that the shares will rebound on Monday as the market sentiment improves. However, in the near term, the stock will resume the downward trend and retest the key support at 1,482, which was about 2% below the current level.