- Summary:

- The crude oil price retreated in the overnight session after OPEC predicted that the release of spr will lead to a surplus

The crude oil price retreated in the overnight session after OPEC predicted that the release of strategic petroleum reserves (SPR) will lead to a surplus in the coming year. Brent, the global benchmark, dropped to $80.56 while the West Texas Intermediate (WTI) dropped to $76.

As you recall, the US announced a coordinated effort to release about 50 million barrels from the strategic reserves. Other countries that are participating in the program are China, India, and the UK. These governments are hoping that these actions will lead to lower oil prices.

However, analysts believe that the 50 million barrels are not enough to stabilize the market. At the same time, they expect that the OPEC cartel will lower their production in a bid to push oil prices higher.

Another reason to worry is the animosity between Joe Biden and Mohammed bin Salman. According to Bloomberg, the two leaders have not talked this year. This means that Salman has lacked the access he had during the Trump administration. Therefore, as a revenge, he could lower production since he has the leverage.

Still, in a report, OPEC predicted that the oil market will see a surplus in early 2022. Precisely, it expects that the surplus will be about 1.1 million barrels per day.

Crude oil price prediction

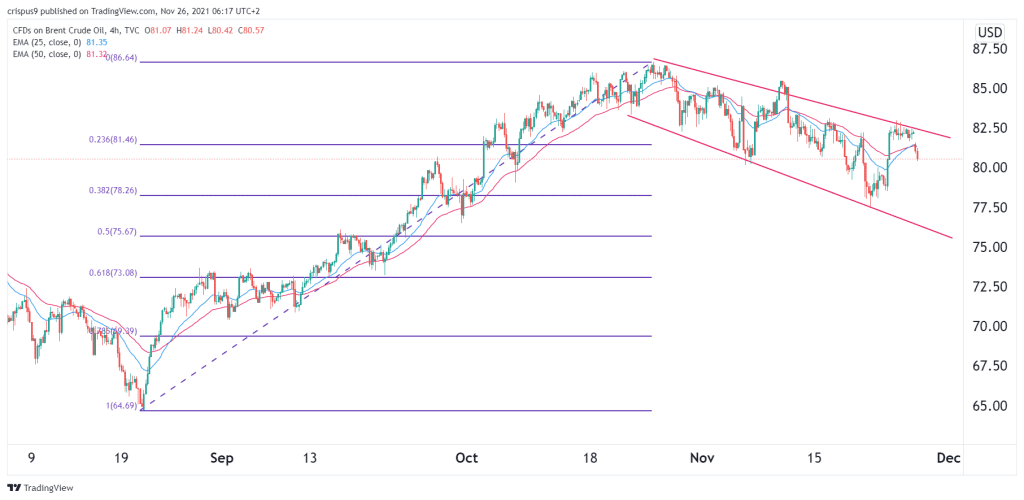

The four-hour chart shows that the Brent crude oil price gapped lower on Friday morning. By so doing, the price managed to move below the 25-day and 50-day moving averages. The price has also dropped below the 23.6% Fibonacci retracement level. It has also moved below the upper side of the descending channel.

Therefore, there is a likelihood that brent will keep falling as the market reflects on the SPR releases. If this happens, the next key level to watch will be the lower side of the channel at around $77. This view will be invalidated if it moves above $82.