- Summary:

- The USD/TRY pair has been in a major bullish trend lately. We explain why this price action happened and what to expect next.

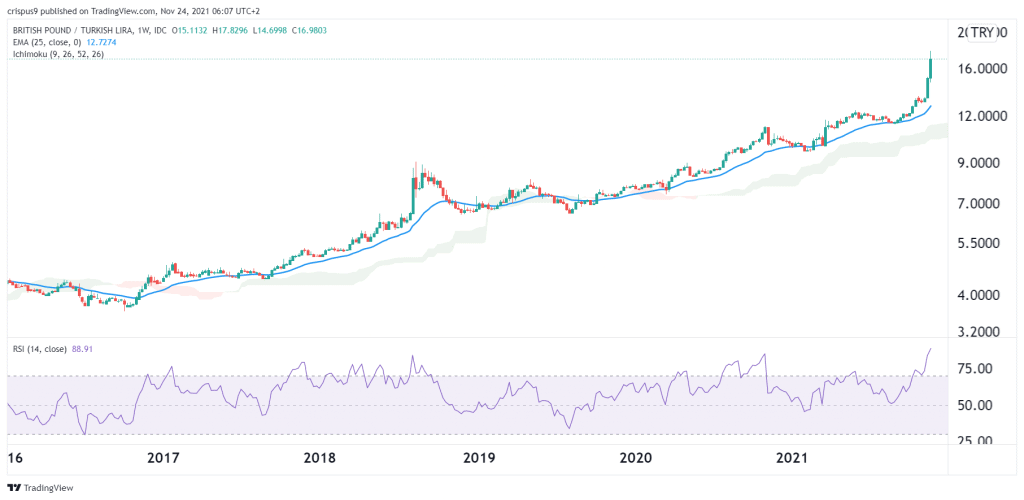

The USD/TRY price soared to an all-time high after a fiery speech by President Erdogan. The pair jumped to a high of 13.50, which was about 40% from its lowest level this year. The EUR/TRY pair jumped to 15.17 while the GBP/TRY jumped to 18.

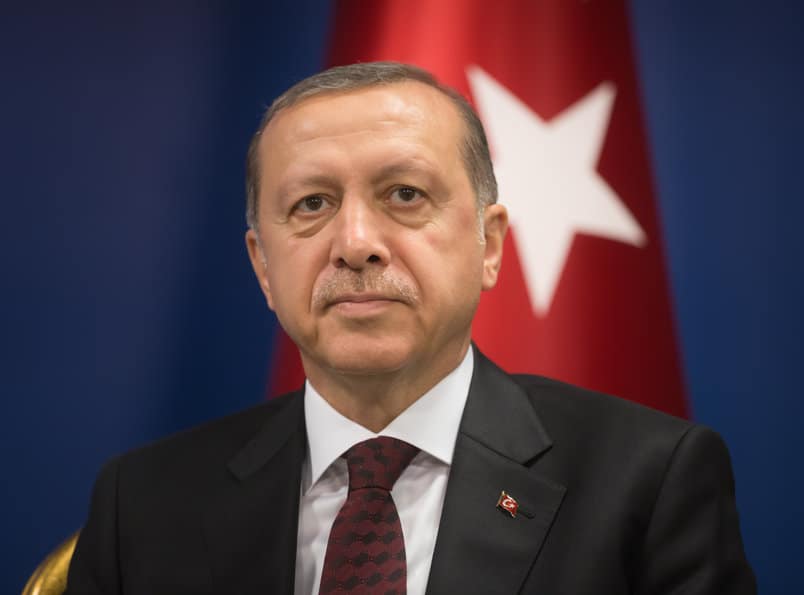

The Turkish lira has gone the Zimbabwe dollar way as President Recep Erdogan and his enablers at the Central Bank of the Republic of Turkey (CBRT) ignore basic facts.

In the past few months, the CBRT has slashed interest rates from almost 20% to the current 16%. In the same period, responsible emerging market central banks like those in Brazil, South Africa, and Russia have all tightened.

These actions mean that Turkey could be about to experience hyperinflation. Indeed, its inflation rate currently stands at about 20%. This trend will continue considering that the Turkish lira has collapsed by more than 20% this month alone. Worse, the president and the CBRT have remained adamant about the policy.

Therefore, there is a likelihood that the USD/TRY and inflation will keep rising. This will lead to a significantly weaker Turkish lira since Turkey is a net importer. This means that residents will start paying more for their basic needs. As you recall, Zimbabwe had to abandon its currency because of reckless decisions such as these.

USD/TRY forecast

The USD/TRY has been in an uptrend in the past decades. For example, the Turkish lira has collapsed by more than 600% since 2008. In the past 12 months alone, it has jumped by more than 60% while it has risen by 25% this month.

On the weekly chart, we see that the pair remains above all moving averages and the Ichimoku cloud. Oscillators like the Relative Strength Index (RSI) and MACD have also continued rising.

Therefore, the USDTRY will continue rising as long as the CBRT maintains its policies. This means that it will likely test the resistance at 15 in the coming weeks.