- Summary:

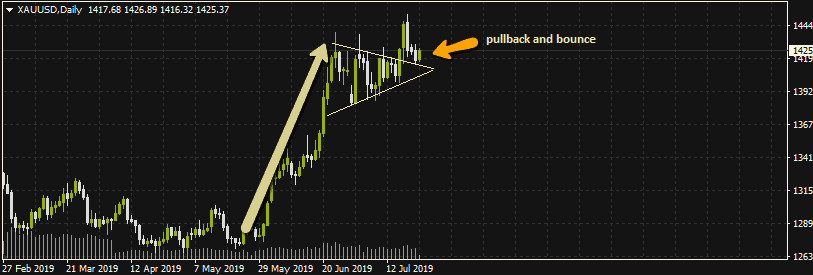

- Gold price is starting move up again after a period of pullback to theh broken bull pennant pattern, as key US data is expected soon.

Gold is trading above $1426 at the moment, following a pullback to the upper border of the bullish pennant from which it broke out last week. Recall that the bull pennant had been identified previously as a result of price action which commenced in May 2019.

Gold prices are warming up for a huge move with less than 7 days left for the conclusion of the FOMC meeting which will decide the new interest rates in the US. Markets are divided as to whether there will be a 25bps or 50bps rate cut, as there have been differing opinions on the matter in speeches made by several FOMC members including the US Fed Chairman Jerome Powell.

Technical Play for Gold

Gold has bounced off the upper border of the bull pennant as expected, since this border is now acting as a support in a role reversal capacity. The US GDP report will be released on Friday July 26. Economists are expecting the US economy to have cooled to a 1.8% growth. A worse-than expected result may set off a gold buying spree, as economic contraction will greatly favour a more aggressive rate cut option. The $1,522 price level is a medium term price target if this expectation plays out.

On the flip side, a better than expected GDP result may force the Fed to keep rate cuts at 25bps and gold may continue to trade at current levels.Don’t miss a beat! Follow us on Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.