- Summary:

- The BP share price is consolidating after recent gains but may have a chance to move higher if cold winter fears surface.

The BP share price is consolidating after recent gains but may have a chance to move higher if cold winter fears surface.

Trading giant Trafigura said yesterday that Europe faces an uncertain winter season, with slowing gas supplies and potential power outages. In the long-term, the Swiss firm claimed the price of oil could also rocket to more than £74 ($100) per barrel. Earlier on Tuesday, was changing hands for £61 ($82) per barrel, slightly down on last week’s highs.

Jeremy Weir, CEO of the Trafigura Group was speaking at the FT Commodities Asia Summit, and said:

“We haven’t got enough gas at the moment quite frankly, we’re not storing for the winter period. So hence there’s real concern that there’s a potential if we have a cold winter that we could have rolling blackouts in Europe.”

If those comments are proved correct then it will provide support for BP shares into the winter with a potential premium if there are shocks.

BP Share Price Analysis

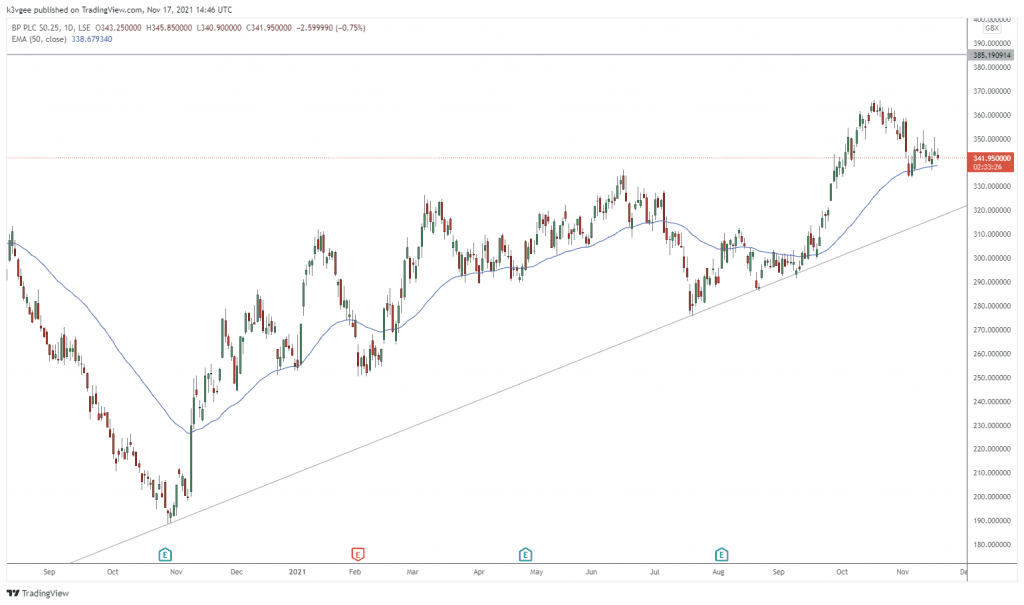

The price of BP trades at 340p after failing to hold higher price above the 360p range. There is a risk that the share price cools off further in the near-term with support coming in at 320p. That is a trendline that stretches back to November 2020 and could be important for another leg higher. There key resistance is the 385p level where there was a gap.

BP Price Chart