- Summary:

- GE could see its share price struggle in the near-term despite the recent three-way company split.

GE could see its share price struggle in the near-term despite the recent three-way company split.

Shares of General Electric surged 6% a week ago after the US conglomerate announced plans to split into three publicly-traded companies for aviation, health care and energy.

Investors welcomed the news from the firm, pushing its market cap above $126 billion, without many details of how the split will impact shareholders. The move also impressed some analysts with Deutsche Bank upgrading the stock and suggesting 17% upside.

“We have never fully understood the need for these businesses to sit together within on company — and we agree that shifting to three pure-play companies should bring better focus and paths to value creation for all three,” DeBlase wrote in a note to clients. “We are fully on board with this plan, and think this is an appropriate ‘end game’ for what has turned out to be a successful transformation.”

However, DB noted the potential for an initial sideways movement in the stock:

“We acknowledge that our own work does caution of stocks trading sideways from the period between spin announcement and spin completion, but we would rather be early given the amount of value that can be unlocked here,” Nicole Deblase wrote.

GE Share Price Analysis

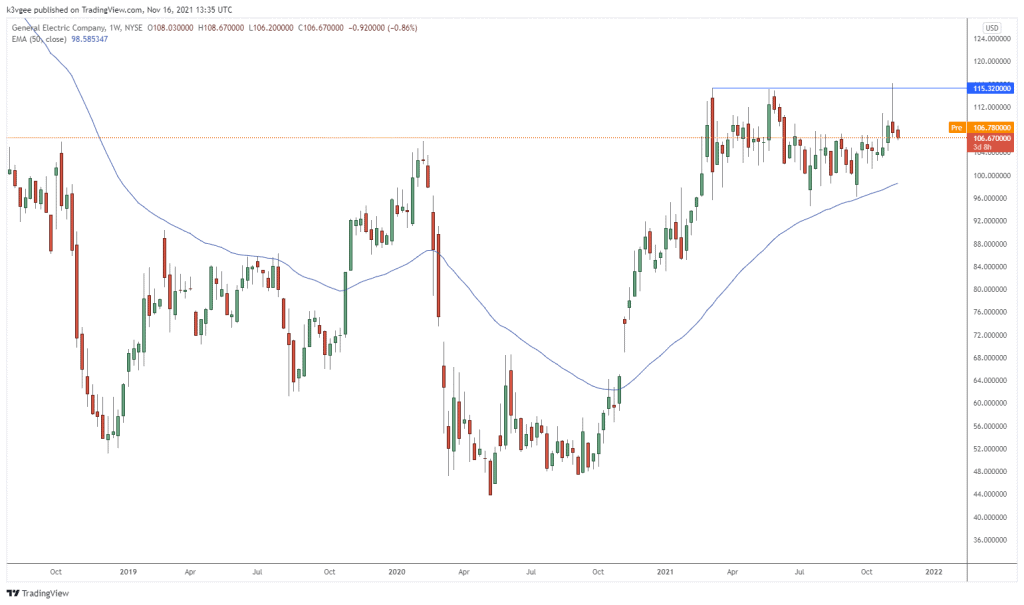

The share price of GE is showing a third weekly resistance failure at $115.00 and that looks like a near-term high. The initial resistance would be the $100 level where the moving average lies but a further correction is possible towards the $84.00 level. The lows in 2020 were around the $45.00 level in GE.

GE Share Price Chart