- Summary:

- The BTC to GBP pairing has declined 2.5% on the day: is the pair pointing to an imminent correction in Bitcoin prices?

Bitcoin price on the BTC/GBP chart has bounced slightly off the support levels, but the pair remains under pressure, with BTC/GBP shedding more than 2% as of writing.

Friday’s decline comes as the US Securities and Exchange Commission (SEC) rejected VanEck’s spot Bitcoin ETF application. In denying the application, the SEC said any changes to the rules to favour the ETF’s approval would not protect the interest of investors and the public.

The SEC refused to accede to a rule change from the CBOE BZX Exchange, which would have opened the door for the VanEck’s Bitcoin Trust to be listed and traded like shares. The news provided the impetus for sellers to accelerate the downside moves of the day in the last hour.

BTC to GBP Price Prediction

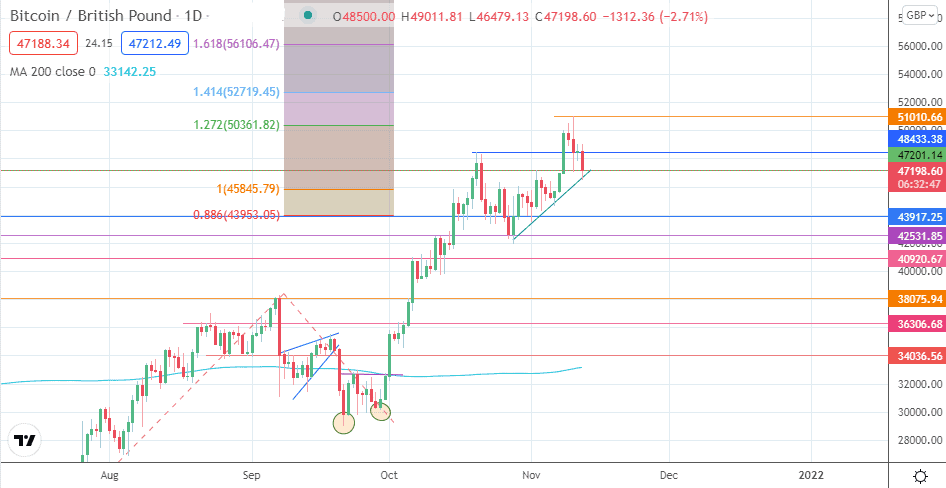

The BTC/GBP pair is retesting the combined support formed by the previous high of 2 November (acting in role reversal at 47201) and the ascending trendline that connects the lows of 28 October, 2 November and 6 November 2021. If this support gives way, the push towards 43917 kicks off. A further decline targets 42531 and 40920.

On the flip side, a bounce on the 47201 support allows the bulls to aim for the 48433 resistance. If the bulls uncap this level, the 51000 all-time high (ATH) comes into view. Above this ATH is the 52719 price mark (127.2% Fibonacci extension), along with 56106 (161.8% Fibonacci extension level) as an additional upside target.

BTC to GBP Chart (Daily)

Follow Eno on Twitter.