- Summary:

- Wall Street indices started mixed the week with the S&P 500 on positive foot adding 0.34% higher at 2,977.90. The Dow Jones currently trading -0.19% lower

Wall Street indices started mixed the week with the S&P 500 on positive foot adding 0.34% higher at 2,977.90. The Dow Jones currently trading -0.19% lower at 27,105, while the Nasdaq trading 0.54% at 8,191 after White House and Congress are finalizing an agreement that would raise the debt limit until July 2021 and increase government spending for two years. Chicago Fed National activity index for June 2019 fell by -0.02%, while the expectations were for 0.10%. The 36 indicators out of 85 improved, while the 49 indicators fell.

U.S. trade negotiators will likely visit China next week for their first face-to-face talk with Chinese officials since the G20 meeting. Traders’ attention focused on the Fed policy meeting next week as hopes of a 50bp cut to interest rates began to fade.

President Trump, a long-time critic of the Fed, called on the central bank to make “deeper” cuts at its next meeting.

“With almost no inflation, our Country is needlessly being forced to pay a MUCH higher interest rate than other countries only because of a very misguided Federal Reserve. In addition, Quantitative Tightening is continuing, making it harder for our Country to compete.”

“It is far more costly for the Federal Reserve to cut deeper if the economy actually does, in the future, turn down! Very inexpensive, in fact productive, to move now,” tweeted Trump.

“The Fed raised and tightened far too much and too fast, in other words, they missed it (big!). Don’t miss it again!”

Earnings are in focus, with around 30% of the S&P 500 reporting before the end of the week, including the likes of Boeing, Caterpillar (CAT), Amazon, Facebook (FB), Tesla, Alphabet (GOOGL), Intel, and Coca Cola.

I still believe that the global reflation scenario is intact and easier credit conditions from most of the major central banks, including the Fed, are coming and will be the dominant fundamental that supports global equities in the long term. Futures markets are predicting almost a 100% probability that the FOMC will lower its fed funds rate by 25 basis points at its July 30-31 monetary policy meeting. A second rate cut is anticipated before the end of the year.

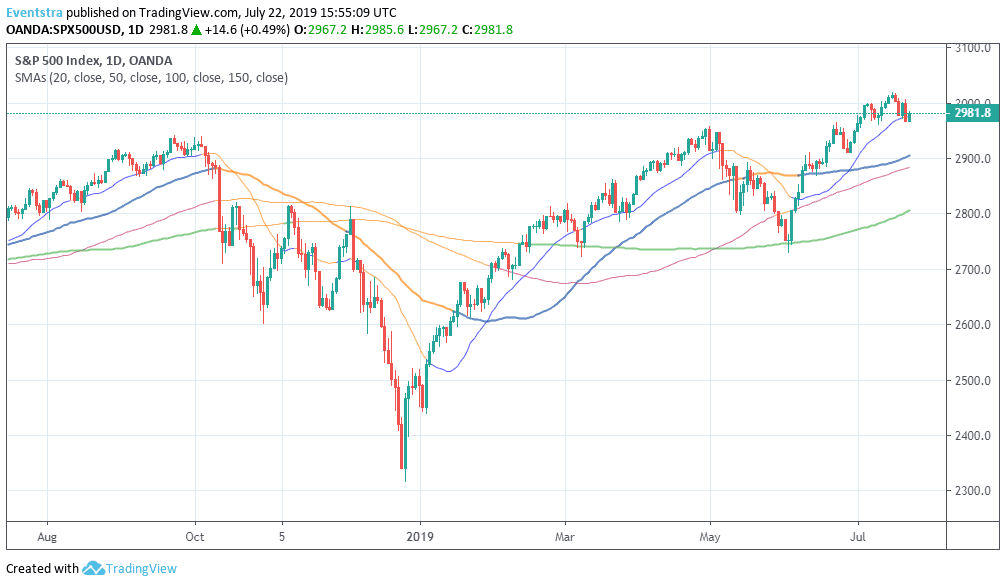

S&P 500 trading above all the key daily moving averages and the bulls are ruling the game for the short term while for the midterm is on a rising trend channel. On the upside immediate resistance is at 3,000 and then at 3,017 high. On the downside S&P 500 first support stands at 2,967 today’s low and then at 2,915 the 50 day moving average. Traders looking to enter long positions can buy if the index crosses above 2,990, targeting the 3,000 level for profits, and can keep their long positions as far the index is trading above the 2,967 mark.

The European Indices ended mostly higher except the IBEX 35 in Madrid which finished 0.15% lower at 9,157. The FTSE 100 finished 0.04 percent higher at 7,512.04 as the pound trades above 1.2480. DAX 30 ended 0.24 percent higher to 12,289 while CAC 40 in Paris also finished 0.18 percent higher at 5,566.

Facebook Earnings July 24: Download our free FB earnings preview report today.

Don’t miss a beat! Follow us on Twitter.