- Summary:

- Outstanding earnings from US companies are driving bullish sentiment on the S&P 500 index as it targets new record highs.

- S&P 500 index inches close to new record highs.

- Weekly jobless claims hit new pandemic-level lows.

- Stellar earnings from US companies lifting sentiment on the index.

Despite the US economy growing at its slowest annualized pace in the 3rd quarter, the S&P 500 index has had a solid opening for the trading day, pushing close to the recently attained all-time highs.

Bullish sentiment on the S&P 500 index was driven by positive earnings from Caterpillar, Merck and Ford. Ford topped earnings estimates to surge more than 12% on market open. Merck and Caterpillar also did well, and companies listed in ten out of the eleven indices listed on the S&P 500 index are all in positive territory.

Also boosting sentiment on the index is a drop in the initial jobless claims from 291K to 280K. The estimates had been for a slight fall to 290K. The S&P 500 index is 0.73% higher on the day.

S&P 500 Price Prediction

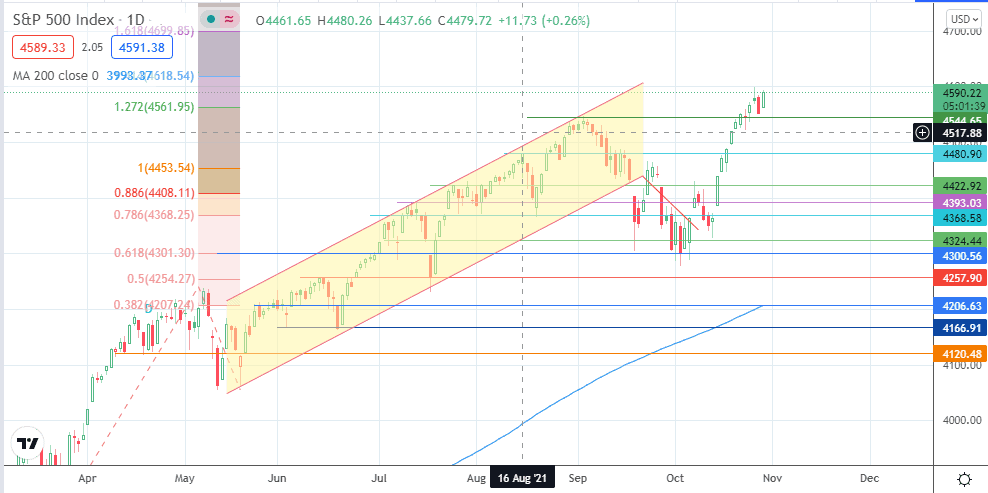

The all-time high at 4598 is the only barrier between the day’s high and a new target at 4618.54 (127.2% Fibonacci extension level). Above this level, 4699 (161.8% Fibonacci extension) could become a new target to the north.

A retracement below the 4544 support level opens the door for a corrective decline which targets 4480 and 4422 as the initial downside targets. 4393 and 4368 also come into the picture as additional targets to the south if the decline is more extensive.

S&P 500 Index: Daily Chart