- Summary:

- The Cineworld share price has given back all of the gains made earlier in the year and looks likely to extend deeper into negative territory.

The Cineworld share price has given back all of the gains made earlier in the year and looks likely to extend deeper into negative territory. Although Cineworld (LON: CINE) closed out Tuesday with a +2.65% gain, the share price is down -21.65% in October, and around -50% from the March high.

Entertainment giant Disney dealt the struggling cinema chains’ recovery plans a severe blow after it delayed the release of several upcoming blockbusters. The latest installments of the popular Thor, Black Panther, and Indiana Jones franchises are expeteced to pushed back several months at least due to production problems. The delays could not have come at a worse time for Cineworld shareholders. The share price had turned a corner in September, reaching a 2021 high of 85.16p. However, a sudden surge in UK Covid case quickly reversed the rally sending the share price tumbling below the key moving averages. Furthermore, the latest setback could drive the price even lower.

CINE Price Analysis

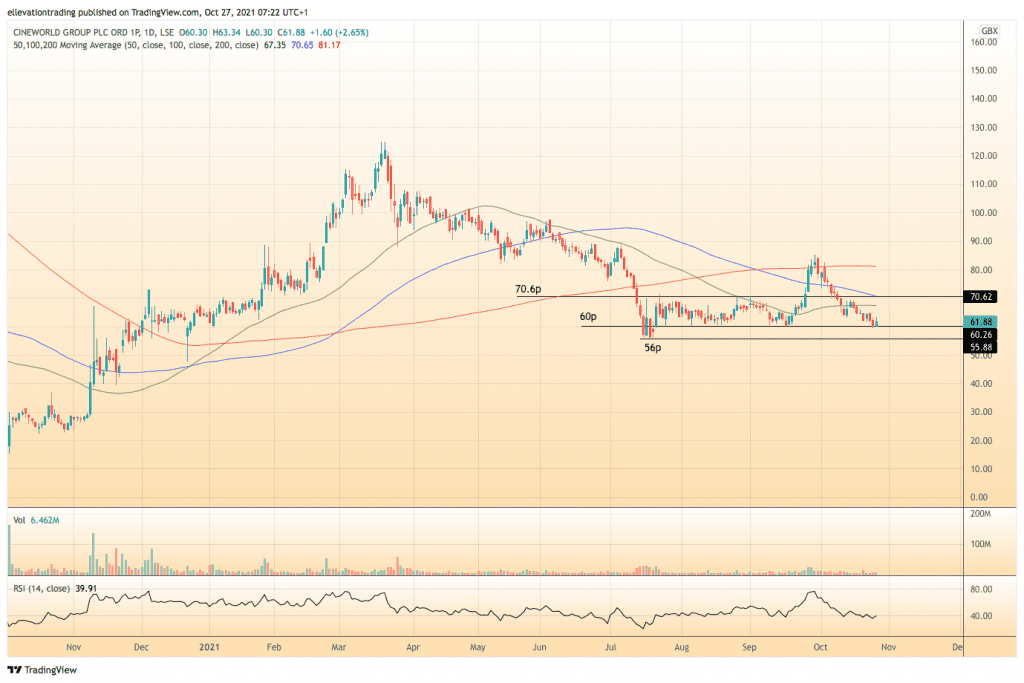

The daily chart shows Cineworld is approaching the 2021 low of 56p. Currently, the interim support at 60p is holding up. However, I expect 56p to be tested soon. If the Cineworld share price makes a new low it should trigger stop-loss selling. In that event, it’s hard to say just how far the price can fall. Although an obvious target on the downside is the traffic on the daily chart around 40p.

On the other hand, if the Cineworld share price continues to hold the 60p level, it could turn higher. Above the market, the 100-day moving average at 70.62p is the biggest obstacle for the bulls to overcome. Successful clearance of 70.62p could potentially build momentum for an extension to the 200-DMA at 81.17p. On balance, the bearish scenario seems likely, and as long as the share price is below the 100-DMA, a new low is my base case. Therefore, my short view becomes invalid on a close above 76.2p.

Cineword Share Price

For more market insights, follow Elliott on Twitter.