- Summary:

- PayPal stock price crashed by more than 5% on Wednesday. The drop happened after Bloomberg reported that it was in talks to buy Pinterest.

The PayPal stock price crashed by more than 5% on Wednesday. The drop happened after Bloomberg reported that the company was in talks to acquire Pinterest. The PYPL stock is trading at $258, which is about 16% below its year-to-date high.

PayPal and Pinterest Merger?

In a report on Wednesday, Bloomberg said that PayPal was in talks to acquire Pinterest, a social media company. The report said that the two were talking about a purchase at $70 per share, which would value Pinterest at more than $35 billion.

In a separate report, the Financial Times said that the price could be significantly higher than that and would value Pinterest at $45 billion. The Pinterest stock price soared after the deal was announced.

Still, analysts are confused about the reasons for this acquisition since potential synergies will be limited. For one, PayPal is a fintech company while Pinterest is a social media company. Besides, Pinterest was valued at about $10 billion when it went public in 2019.

In most cases, overpaying for a company is usually a good thing. However, in this case, PayPal will be buying a company that has recently lost momentum. User growth has even slowed. At the same time, Pinterest, like all social media companies is seeing some regulatory challenges.

In a note, analyst Andrew Jeffrey of Truist said that the deal made no sense. He added that the purchase would be an “act of desperation” as PayPal’s business slows. Its Venmo boost has faded and is seeing strong competition from the likes of Square and Wise. He wrote:

“We are perplexed by this potential transaction, and see little or no strategic rationale. In many ways, we believe a PayPal/Pinterest combination would be reminiscent of PayPal’s historical eBAY relationship, the unwind of which created significant shareholder value.”

PayPal stock price forecast

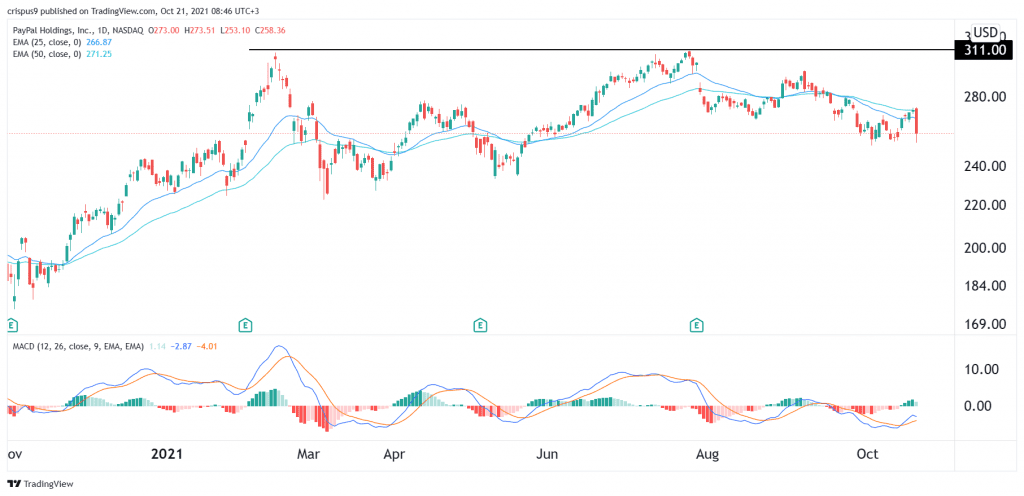

The PayPal stock price has been in a difficult position recently. The stock has crashed by 18% from its highest level this year. The stock has struggled to move above the key resistance at $310. It has also moved below the 25-day and 50-day moving averages. Notably, it also seems like it is forming a head and shoulders pattern.

Therefore, there is a likelihood that the PYPL stock will stage a major decline as traders wait for its coming earnings. The bearish view will be invalidated if the stock moves above $273.