- Summary:

- The GBP/USD is set to record its biggest weekly jump in 5 months after the market started to price in an early BoE interest rate hike.

The GBP/USD pair has surged this Friday and looks set for the most significant weekly jump in 5 months. The boost for the Pound has come from rising expectations of a possible rate hike by the Bank of England in its December meeting.

BoE Governor Andrew Bailey set the tone for the Pound’s strength this week when he said on Monday that there was a need to prevent inflationary pressure from becoming embedded. Another BoE policymaker Michael Saunders also flew a kite, calling on UK households to prepare for rate hikes.

The Pound is up 0.63% on the day and looks set for a higher weekly close by as much as 1.07%.

GBP/USD Outlook

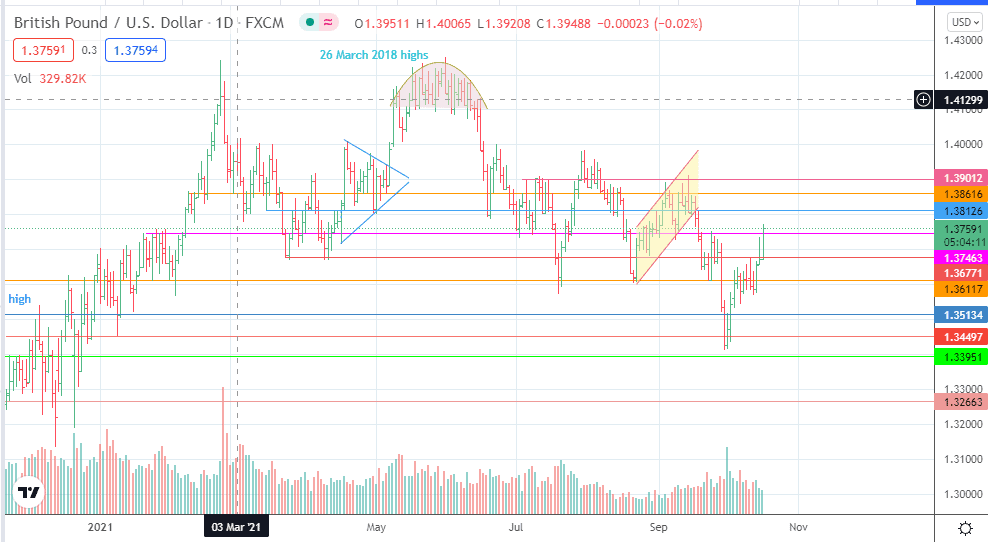

The V-shaped recovery which has followed the GBP/USD has violated the resistance at 1.37463. A break above this level clears the pathway towards 1.38126. Additional targets to the north are seen at 1.38616 and 1.39012.

On the flip side, a resumption to the downside follows a breakdown of 1.36117 (20 August and 23 September lows). This scenario will allow 1.35134 and 1.34497 to become new targets to the south.

GBP/USD: Daily Chart

Follow Eno on Twitter.