- Summary:

- The Palantir share price could see some gains if the evolving double bottom pattern is confirmed, with 26.24 being the nearest target.

This Friday, the Palantir share price could open higher, following a bullish start to the 3rd quarter earnings season. The company has secured several new partnerships with the US Veteran Affairs Department, the US Army and MSP Recovery. MSP Recovery will integrate Palantir’s Foundry software to bring legal and healthcare data into a single ecosystem.

These partnerships are just three of the new contracts it has secured recently. The data analytics company will release its earnings on 18 November.

Palantir Share Price Outlook

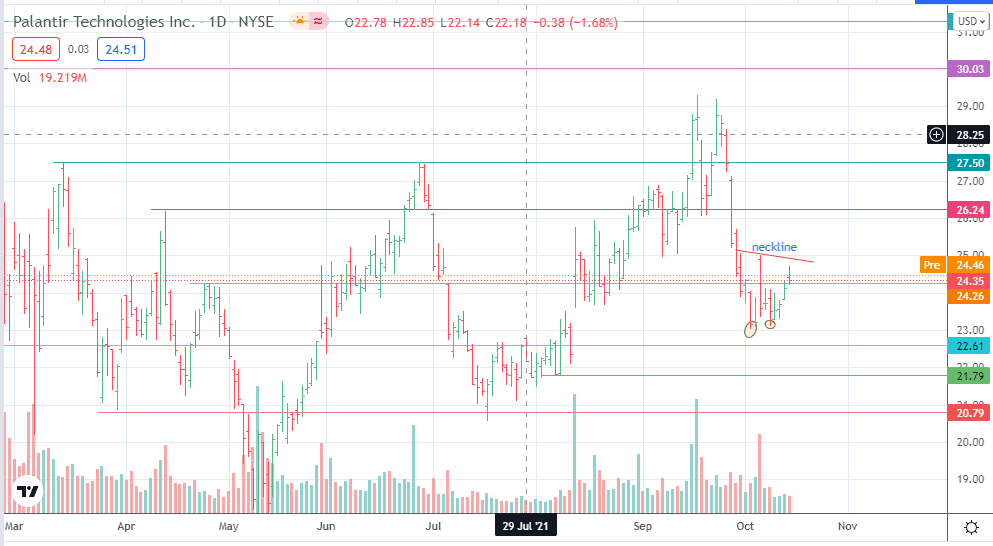

The evolving double bottom pattern on the daily chart holds the key to near-term price action. Thursday’s decline has found support at the 24.26 price mark. A bounce from here targets the neckline. A neckline break confirms the pattern and opens the door for a measured move to 26.24 (14 April, 1 July and 13 September highs). If the bulls uncap this target, 27.50 (15 March and 28 June highs) and the former double top at 29.00 become the additional upside targets.

This outlook is only negated if the bears take out the 24.26 support level. This move opens the door towards the bottoms at 23.00, with additional support coming in at 21.79 (3/6 August highs) and 20.79.

Palantir: Daily Chart

Follow Eno on Twitter.