- Summary:

- The Barclays share price is staring at 200p, boosted by the upbeat earnings by its American peers. The BARC stock is trading at 196p

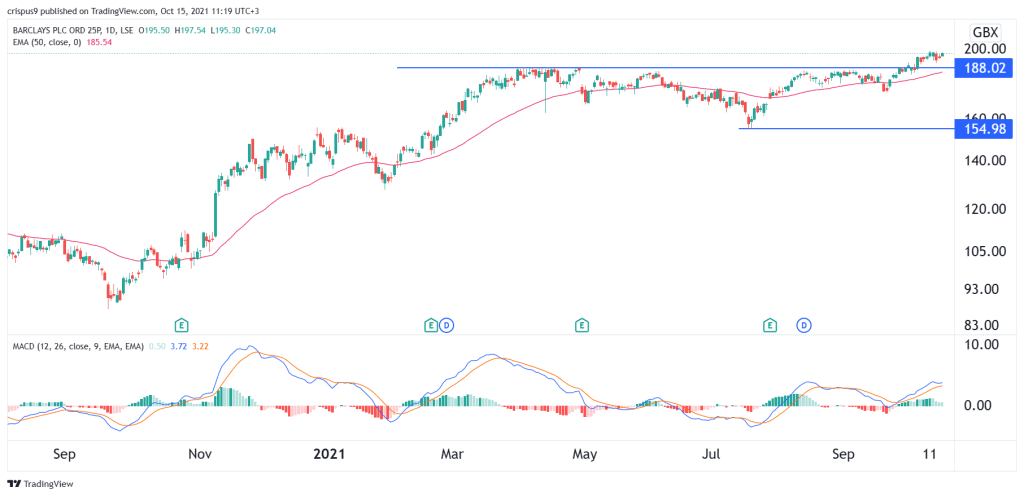

The Barclays share price is staring at 200p, boosted by the upbeat earnings by its American peers. The BARC stock is trading at 196p, which is about 125% above the lowest level in October.

Bank earnings

The biggest banks in the United States published strong earnings this week. All the big banks that have already published their results this week have beaten the consensus estimate.

JP Morgan, the biggest bank in the United States, published revenue of $30.44 billion, which was higher than the median estimate of $29.8 billion. Its profit of $3.74 per share was also better than the median estimate of $3. This growth was boosted by the company’s release of reserves and fees from investment banking. However, its fixed incone trading declined by 20%.

Meanwhile, Bank of America said that its revenue jumped to $22.87 billion in the third quarter while its profit rose to 85 cents a share. Its net income rose by 58% to $7.7 billion. The company also benefited from its investment banking, wealth management, and equity trading while its fixed-income trading declined.

Morgan Stanley, on the other hand, had revenue of more than $14.75 billion, which was higher than the expected $14 billion. Like the other banks, this performance was mostly because of its investment banking and wealth management business.

Therefore, like I wrote earlier this week, the Barclays share price is usually sensitive to American banking results because of its international arm. The international arm has Barclay’s wealth management, investment banking, and other trading operations. As such, going by these results, there is a likelihood that Barclay’s also had a good quarter.

Barclays share price forecast

In my article this week, I wrote that the Barclays share price will keep rising in the near term as investors focus on bank earnings. This prediction was accurate as the stock has risen in the past few consecutive days.

The stock also rose above the key resistance level at 188p, which was also the highest level this year. The stock struggled to move above this level several times this year.

At the same time, the bullish trend is being supported by the 25-day and 50-day moving averages while the MACD renains above the neutral level. Therefore, the path of the least resistance for the stock is to the upside. I suspect that it will gain more momentum if it moves above the resistance at 200p.