- Summary:

- EURGBP is under selling pressure the last hours as investors concerns about hard Brexit ease after comments from Michel Barnier that EU is ready

EURGBP is under selling pressure the last hours as investors concerns about hard Brexit ease after comments from Michel Barnier that EU is ready to work on alternative arrangements for Irish border issue. UK Parliament yesterday voted in favor of an amendment that prevents the Prime Minister to suspend the Parliament and allow the country to leave the European Union without a deal. Earlier today the German Producer Price Index (MoM) came in at -0.4% below expectations of -0.2% in June while the Producer Price Index (YoY) registered at 1.2%, below expectations of 1.4% in June. The macro data from EU continue to disappoint investors while this week we have stronger data from The UK. The scenario that ECB is looking to adjust inflation target also weigh on Euro.

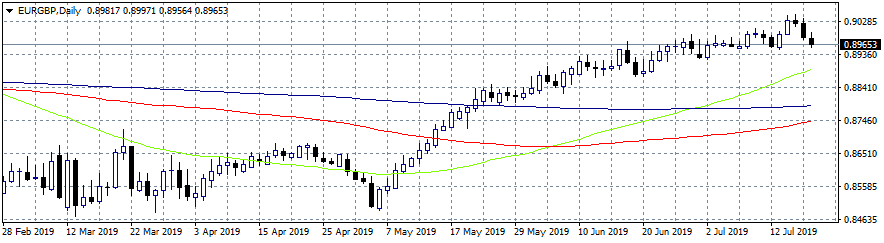

On the technical side the short term momentum turned bearish for the pair as it trades below all major hourly moving averages. Intraday traders can initiate a short position targeting the 50 day moving average at 0.8891 while if that support failed to hold, the downward move will accelerate and drive prices down to 0.8789 the 200 day moving average. A protective stop should be placed at 89.96. On the upside immediate resistance for the pair stands at 0.90 the 50 hour moving average while more offers will emerge at 0.9038 the high from yesterday.Don’t miss a beat! Follow us on Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.