- Summary:

- GBPUSD gives up 10 pips after the United Kingdom Public Sector Net Borrowing came in at at £6.5B topping expectations of £3.2B in June.

GBPUSD gives up 10 pips after the United Kingdom Public Sector Net Borrowing came in at at £6.5B topping expectations of £3.2B in June.

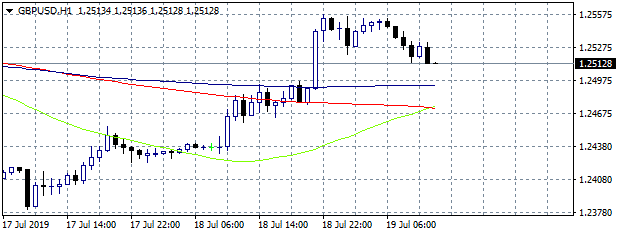

GBPUSD moved sharply higher yesterday as there are increasing odds for a solution to the Irish border after Michel Barnier that the bloc is ready to work on alternative arrangements for Irish border issue. The pair stopped at 1.2557 yesterday and today also failed to break above that level. The short term momentum is positive for the pair as it trades above all major hourly moving averages. Intraday traders can wait for 1.2493 the hour moving average to enter a long position targeting today high for profit, a stop order should be also activated at 1.2473 the 100 hour moving average. Bears must be more cautious at current level, a break below 1.25 can accelerate the pressure down to 1.2473, while a break below will drive price down to where it started yesterday at 1.2423.Don’t miss a beat! Follow us on Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.