- Summary:

- The pattern on the daily chart points to the potential for the 4D Pharma share price to push towards $45 in the near term.

The 4D Pharma share price has closed the day’s trading session in the red, losing 2.65% in a day marked by low trading volumes. This follows Wednesday’s decline after the 4D Pharma share price had notched a gain of 5.26% on Tuesday. Tuesday’s uptick followed the release of positive data from one of its ongoing clinical trials.

New data from its Phase 1 and Phase 2 clinical trials of MRx4DP0004, a potential candidate for the treatment of asthma, showed improvement in symptoms in 83.3% of patients who received it, compared with 50% in a control group that used SABA inhalers. No severe health side effects were seen, paving the way for the next clinical trial phase. While the news boosted sentiment on the day, enthusiasm around the stock dried up after it hit a key resistance.

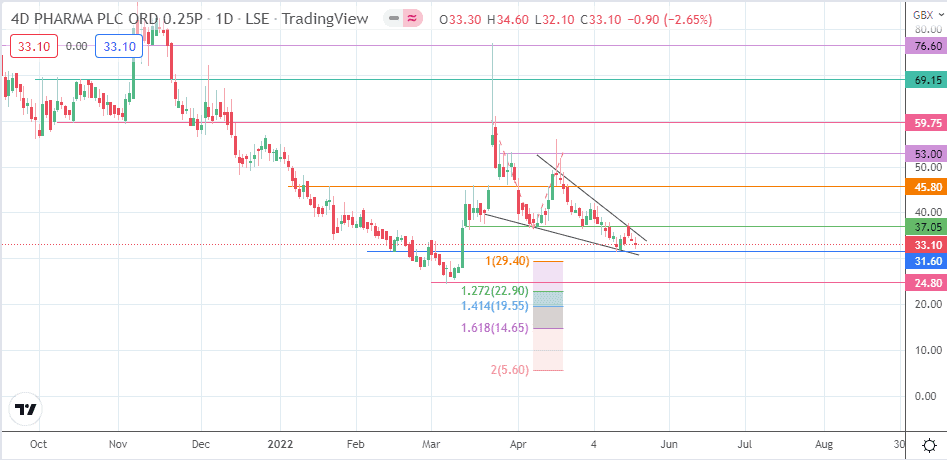

The 4D Pharma share price action is evolving into a falling wedge. This could decide where the price will go without any new fundamental triggers.

4D Pharma Share Price Outlook

The evolving falling wedge pattern on the daily chart points to an upside breakout. This could come from a bounce on the 31.60 support level (15 February and 13 May lows). This bounce has to take out the resistance at the 37.05 price mark (17 May high), with 45.80 (16 March high) set to serve as the only resistance left before the measured move attains completion at the 53.00 resistance (28 March high).

On the flip side, a decline below the 31.60 support invalidates the pattern and opens the door for the bears to make a push toward 24.80 (7 March low). A break of this support sends the price activity to new lows, with the 127.2% Fibonacci extension at 22.90 coming into the mix as the initial target in record low territory. 19.55 and 14.65 are additional price targets to the south, where the 141.4% and 161.8% Fibonacci extension levels are located.

DDDD: Daily Chart