- Summary:

- Oil cartel OPEC sees a bearish outlook for cude oil fundamentals for the rest of 2019 in its August monthly report, citing weak global economic growth.

The Organization of Petroleum Exporting Countries (OPEC) has released its monthly Oil Market Report for August 2019, in which the oil cartel sees a negative outlook for the crude oil market for the rest of the year. In the report, OPEC noted a “somewhat bearish” outlook for crude oil market fundamentals for the rest of 2019, citing global economic slowdown. The OPEC report did not forecast any changes to global demand, which remains at 1.14millon barrels per day.

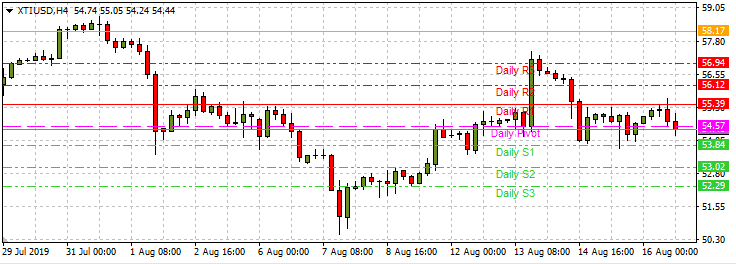

Crude oil price, which had earlier added 2% on the day, immediately came under bearish pressure on the remarks from OPEC, prompting the West Texas Intermediate (WTI) crude oil variant to drop to as low as $54.24, one hundred and forty cents below the day’s high price of $55.64. As at the time of writing, crude oil had recovered some of these losses and is now resting at $54.79, about 20 cents above the central pivot support area.

Other quotes from the monthly report as reported by Reuters are as follows:

“OPEC cuts forecast for 2019 global oil demand growth to 1.10 million bpd (previous forecast 1.14million bpd) on economic slowdown…OPEC sees 2020 demand for its crude averaging 29.41million bpd, up 140,000 bpd from previous forecast, on lower non-OPEC supply view.”

“Saudi Arabia tells OPEC it cut July crude output to 9.58million bpd, down 202,000 bpd m/m.”

“OECD oil inventories rose in June and stood 67 million barrels above latest 5-year average – the level originally targeted by supply cut deal.”